"What Happens If the Short Leg of My Bull Call Spread Is Assigned?"

Question By Lance

"Do I require funds to cover the write position in a bull call spread if I get exercised on the write position in the trade. Can I avoid having to buy the shares in this situation? what can I monitor to avoid this? What are alternatives to still be able to profit from this particular trade? Thanks."Asked on 14 June 2011 |

Answered by Mr. OppiE

Hi Lance,

Getting the short leg of any options spread strategies assigned early and breaking the position is a very real risk all options position traders must accept and take. Indeed, nothing breaks an options strategy more than the early assignment of the short legs but having the short leg exercised early isn't totally bad.

First of all, before I go into why getting the short leg of a bull call spread assigned early isn't a bad thing, lets first explore the possibility of the out of the money call options in a bull call spread getting assigned early.

If you held on to the position to the extend where the stock has rallied past the strike price of the out of the money call options, then the position would already be very close to its maximum potential profit. In this situation, you would be better off closing off the whole position and then reinvesting those capital somewhere else where more options trading profits can be expected.

When short call options are assigned, you will have to sell the stocks to the holder of those call options and if you do not already own the stocks, you will have to short sell the stocks and end up with a short stock position. As such, you won't be buying the stocks as implied in your question. What if you do not have the cash margin needed to hold the short stock position when the out of the money call options are assigned? In this case, your broker would automatically liquidate the short stock position in the open market immediately upon assignment, posting the resultant profit or loss in your account, hopefully with minimum slippage due to bid ask spread and commissions.

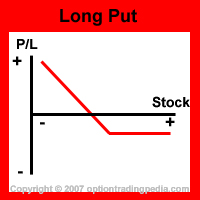

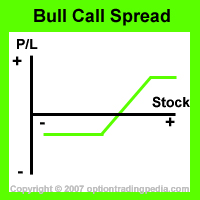

1. If you have the cash margin to hold the short stock position, you would end up with short shares and long calls which creates a synthetic long put (Read our tutorial on Synthetic Positions). Compare the risk graph of a synthetic long put (which is the same as a long put) and the risk graph of a Bull Call Spread below:

2. If you do not have the cash margin to hold the stock stock position, you would end up with only the long calls which is a bullish options strategy anyways. You could then choose to hold on to it if you continue to be bullish on the underlying stock or write some more out of the money call options.

In conclusion, it is not likely for out of the money short call options to be assigned early and for a bull call spread, you really should be closing the position before the short call options go too much in the money. If the short call options are assigned early and you do not have the cash margin to hold the resultant short stock position, your broker would most likely liquidate those short stocks for you the moment the assignment is complete.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by