|

|

Thanks to relatively recent technological breakthroughs, day traders are able to work when and where they choose. Cyberspace is the new trading arena and the financial markets are more accessible than ever. While the folks down the street are sleeping soundly in their beds, it is possible to trade the E-Mini S&P 500 futures, the German DAX futures, or a number of other futures contracts; before the sun rises traders may buy or sell the DAX futures, or a number of other products. And geography is no longer a limitation. The DAX is a German index, but one does not need to be in Germany or even in Europe to trade it. Many traders electronically trade 24-hours a day.

Remember that day and night, somewhere, there is always an active market. Generally, the liveliest trading center is the area where the sun is shining the brightest. That means once the trading pits in New York and Chicago close for the day, one's focus must follow the sun. The NYSE closes at 3:00 PM CT and the CME (where the S&P futures and other futures and options are traded) closes at 3:15 PM CT.

|

However, only fifteen minutes later, 3:30 PM CT, the Globex (electronic) system operated by the CME fires up again. This means an array of products can be traded throughout the afternoon, evening, and early morning hours. The Globex session runs nearly 24-hours and does not end until 3:15 PM CT the following day. Other exchanges also operate electronic systems that allow trading to continue while the traditional trading pits are closed.

Many traders fear the night market because volume is thin and familiar indicators like the NYSE Tick or the NYSE and Nasdaq advance/decline data are not available. However, even though New York and Chicago are quieter, Asia and Europe are busy. Therefore, I look at foreign indices and use them as indicators to gauge both U. S. and foreign markets. I use the Nikkei, Hang Seng, DAX, CAC, FTSE, and SMI to get a sense of how Asia and Europe view the markets. A helpful website to gain a sense of global market sentiment is Yahoo Finance. Go to www.yahoo.com, scroll down the left side and click on finance, then scroll down to investing and look at today's markets and select indices, click on world and view European and Asian prices. (Caution: these are delayed prices and not real-time quotes. Use them only to gain a view of global sentiment).

I begin analyzing the evening markets when the Globex opens. My first step is to determine how the E-mini S&P is trading. I want to know whether the bulls or the bears are dominant as they come out of the chute. I record the high and the low of the E-mini S&P 500 futures during the first 30-minutes of action. These highs and lows serve as pivots to guide me. Before buying the E-mini S&P or anything else, I generally want prices to rise above that initial high, and prior to selling I want to see the low broken. Consequently, I may not place a trade for hours.

Asia dominates the evening hours. The Nikkei opens in Tokyo at 6:00 PM CST (7:00 PM CDT). Trading on the Hang Seng starts two hours later at 8:00 PM CST (9:00 PM CDT). When Asian trading is winding down, the sun is rising in Europe. DAX trading begins at 1:00 AM CT and a short time later the FTSE, CAC, and SMI indices start trading. When I first gained the ability to trade around the clock, I went crazy. I wanted to make every trade and watch the markets move 24-hours a day. As exhaustion set in, I returned to my senses. Sleep is essential to both good health and good trading. One has to have a clear head and the wherewithal to analyze correctly and execute properly. Trading while one is sleepy and lethargic is a formula for disaster. Therefore, even though opportunities are present around the clock, it is very important to select trading times with care. I generally enjoy my family in the evening hours and sleep until Asia closes and Europe opens. Two of my favorite trades are made between 4:00 and 7:00 AM CT. One is an E-mini S&P 500 futures trade and the other a DAX futures trade.

S&P 500 Futures Early Morning Trade

From observation and experience, I have learned that just after 4:00 AM CT is often a good time for me to trade the E-mini S&P. I record the high and the low from 3:30 AM to 4:00 AM CT and use those price points for reference. If prices rise above the high I am more bullish, if they fall below the low, I am bearish. Once I obtain these reference points, I visit Yahoo, follow the steps above, and check foreign markets. What is the world sentiment? I use a problem solving technique that I learned in my law school days: I create a "T" square and list the pros of buying and selling. If the bulls have a strong argument, I buy just above the high of my latest reference bar. If the bears appear to be out in force, I sell below the low of the bar.

One great example of this trade occurred on June 25, 2009. The high of the E-mini S&P 500 reference bar was 905.50 and the low was 902.25. How was the world trading? Asia was up from the previous day's close, the Hang Seng closed up 1.83% but the Nikkei was up 2.1%, however, they were virtually flat from the open and could not seem to go higher. All European markets gapped lower on their open and were telling the same story as Asia; the market could not go higher. Chart 1 shows the time between 3:30 AM CT and 8:00 AM CT. Those who went short the E-mini S&P as it crossed the bottom of the 3:30 to 4:00 AM bar had a great money making opportunity. As the sun began rising in the U.S., traders began selling and prices sharply declined. The move continued until the US day market opened.

DAX Futures Sun Rise Trade

Germany is Europe's largest economy and the DAX is a Blue Chip Index consisting of 30 of Germany's biggest corporation. It is a powerful index that reflects the health of some of that nation's largest corporations. For the last eight years, I have actively traded the DAX Futures; today it is one of my favorite day trading products. The DAX trades on the Eurex, a European options and futures exchange located in Frankfurt, Germany. The DAX futures trade in .50 increments and the value of each point is 25 euros (about $35.00 U.S. dollars as of 6/30/09). Currently, the average daily range exceeds well over 100 points. That wide range offers a number of profit taking opportunities. Each weekday morning the DAX Futures open for electronic trading at 1:00 AM CT (2:00 ET). The session continues until the NYSE closes at 3:00 PM CT (4:00 ET).

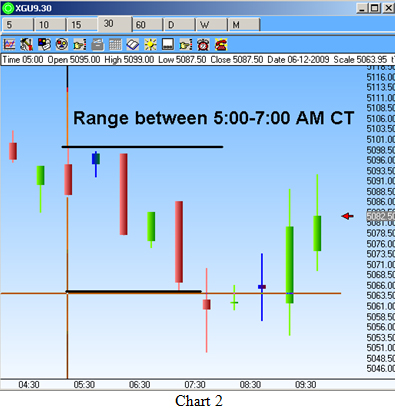

Like our Nasdaq, the DAX is an entirely electronic exchange. One of the best times to trade this index is between 5:00 AM and 7:00 AM CT (see Chart 2). Here are the basic steps I follow. First, I get a snapshot of the global action. Again, I use Yahoo Finance as noted above. How did Asia close out, and what is happening in the U. S. and Europe? Is the trend up or down? Again I use the "T Square" and evaluate the case for buying and selling. I want to join the winning team.

If a direction is discernible, I concentrate on the DAX and study its path since its open. Where is short-term support and resistance? I use 30-minute charts and key numbers to make that determination. I bracket the nearest support and resistance levels. If the market sentiment is bearish, I look to sell just after support is broken or if it is bullish, I identify a buying point just over resistance.

Then, I focus on volume and sales. I want to know how much selling vs. buying is coming into the market and when is it doing so. I have a proprietary indicator, the V-Factor that helps me with this analysis. Without the V-Factor, it is possible to study time and sales figures or some other volume indicator. I use the momentum of the market so I need to know when a wave of activity is forming. Then I jump on that wave and ride it to profits.

Finally, I look at key numbers. Here is a personal rule of mine: I sell on the nines and buy on the ones. That is, if my support and resistance bracket is 4938 to the high and 4922 to the low, I look to buy at 4941 and sell at 4919. Once in the trade, I take some quick profits on a portion of my positions. However, if the move seems strong, I may hold a few contracts until just before the U.S. begins its day session at 8:30 AM CT.

Once our markets open for business, the DAX is an excellent indicator. I trade and monitor it all day long. If I am looking to go long in another market, but the DAX is sluggish or negative, I think twice before taking that buy. Or, if our markets are covered with gloom and doom, but the DAX is bullish, I take my hand off the mouse and wait for the DAX to support the move before I jump in to an inconsistent arena.

If you are unfamiliar with the DAX, you should watch it trade for a while before risking any money. During certain times during the day and night, the DAX can move very quickly, which means it can be dangerous for the novice. As with any new trading area, begin slowly and earn your wings. To learn more about the DAX Futures, visit the Eurex Exchange website at www.eurexchange.com.

|