How Does The Double Iron Butterfly Spread Work in Options Trading?

|

|

| Learn How To Read These Charts | |

Double Iron Butterfly Spread - Introduction

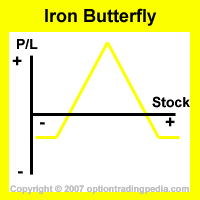

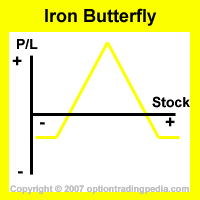

The Double Iron Butterfly Spread is a complex credit neutral options strategy which is simply the combination of two Iron Butterfly Spreads. Iron butterfly spreads are credit spread neutral strategies used for targeting maximum profitability around a single price point with favorable reward risk ratio having higher maximum potential gain than loss. When two such Iron Butterfly Spreads are put together, a Double Iron Butterfly Spread is formed which either extends the maximum profit range of the Iron Butterfly Spread or allows you to target two different maximum profit price points.

Studying the Iron Butterfly Spread first makes the Double Iron Butterfly Spread easier to understand.

Why Use Double Iron Butterfly Spread?

The Double Iron Butterfly Spread is the credit spread version of the Double Butterfly Spread with almost the exact same payoff across the same strike prices. The Double Iron Butterfly Spread is used for two purposes; One, to extend the profitable range of a single Iron Butterfly Spread by putting on another Iron Butterfly Spread with overlapping strike prices, we call that the Wide Range Double Iron Butterfly Spread. Two, to target two different possible price outcomes, we call that the Double Peak Double Iron Butterfly Spread.

Wide Range Double Iron Butterfly Spread

A Wide Range Double Iron Butterfly Spread is simply putting two Iron Butterfly Spreads together with overlapping strike prices on two of the three strike prices. This has the effect of actually extending the maximum profitable price range. See comparison below:

|

|

As you can see from the above payoff diagrams, instead of having maximum profit on a single price forming a sharp payoff peak, the Wide Range Double Iron Butterfly Spread has a plateau peak instead of a sharp peak across a range of prices. This means that the Wide Range Double Iron Butterfly Spread can achieve maximum profit across more prices than a single classic Iron Butterfly Spread can.

Why Not Just Use an Iron Condor Spread?

An Iron Condor Spread is exactly like an Iron Butterfly Spread but uses two different center strike prices across the price ranges that you want maximum profit to occur. This is produces an almost exact same payoff profile as a Wide Range Double Iron Butterfly Spread with maximum profit across the exact same strike prices and almost exact same breakeven prices. However, the Iron Condor Spread tends to produce a lower maximum profit than the Wide Range Double Iron Butterfly Spread but also a lower maximum loss. Below are the trade calculation for both Iron Condor Spread and Wide Range Double Butterfly Spread across the same strike prices and identical number of contracts on QQQ.

As you can see from the comparison above, the Wide Range Double Iron Butterfly Spread produces a higher maximum profit and a higher maximum loss than the Iron Condor spread with a much lower margin requirement. In the above calculation, the Wide Range Iron Butterfly Spread requires only $710 in margin while the Iron Condor Spread requires $2390 in margin. As such, having a much lower margin requirement (which translates into a higher ROI) and higher maximum profit (which again is higher ROI) is what makes the Double Iron Butterfly Spread more desirable than the Iron Condor Spread. However, since the Double Iron Butterfly Spread is a 8 legged options strategy while the Iron Condor Spread is only 4 legged, the Iron Condor Spread will require much lesser commission which needs to be taken into consideration when determining which of the two fits your situation best.

How To Use Wide Range Double Iron Butterfly Spread?

There are 8 option trades to establish for this strategy : 1. Buy To Open X number of Out Of The Money Call Options. 2. Sell To Open X number of At The Money Call Options. 3. Buy To Open X number of Out of The Money Put Options. 4. Sell To Open X number of At The Money Put Options. 5. Buy To Open X number of Call Options at 1 strike +/- the Call Options at (1). 6. Sell To Open X number of Call Options at 1 strike +/- the Call Options at (2). 7. Sell To Open X number of Put Options at 1 strike +/- the Put Options at (4). Buy To Open X number of Put Options at 1 strike +/- the Put Options at (3).

(Buy OTM Call + Sell ATM Call + Sell ATM Put + Buy OTM Put) + (Buy OTM Call + Sell OTM Call + Sell OTM Put + Buy OTM Put)

The exact trade made in the example above was:

Wide Range Double Iron Butterfly Spread Example |

||||

| Iron Butterfly Spread 1 | ||||

| Order | Amount | Contract | Unit Price | Cost |

| Buy to Open | 5 | QQQ Jan89Call | $0.31 | $155 |

| Sell to Open | 5 | QQQ Jan87Call | $1.11 | ($555) |

| Sell to Open | 5 | QQQ Jan87Put | $0.82 | ($410) |

| Buy to Open | 5 | QQQ Jan85Put | $0.33 | $165 |

| Iron Butterfly Spread 2 | ||||

| Buy to Open | 5 | QQQ Jan90Call | $0.13 | $65 |

| Sell to Open | 5 | QQQ Jan88Call | $0.61 | ($305) |

| Sell to Open | 5 | QQQ Jan88Put | $1.33 | ($665) |

| Buy to Open | 5 | QQQ Jan86Put | $0.52 | $260 |

The easiest way to determine which strike prices to enter into is to first determine the middle strike prices for the two Iron Butterfly Spreads. In the example above, the desired outcome was to achieve maximum profit across $87 and $88, as such, becoming the middle strike prices for the two Iron Butterfly Spreads. After that is decided, all you have to do is to go one or two strikes lower for the long put and one or two strikes higher for the long call.

Choice of Long Leg Strikes for Wide Range Double Butterfly Spread

The lesser out of the money the long legs are, the more expensive they become, lowering maximum profit but also lowering maximum loss while also decreasing breakeven range. The more out of the money the long legs are, the less expensive they become, increasing maximum profit but also increasing maximum loss and breakeven range. There is no perfect solution.

Choice of Short Leg Strikes for Wide Range Double Butterfly Spread

The choice of short leg strikes depend on what price range you want maximum profit to occur across. However, these two strike prices should typically not be more than 1 strike apart otherwise the peak payoff profile becomes a double peak rather than a plateau.

Double Peak Double Iron Butterfly Spread

The Double Peak Double Iron Butterfly Spread is simply two Iron Butterfly Spreads targetting two different maximum profit prices. This forms a payoff profile having two profit peaks rather than just one. See the comparison pictures below:

|

|

The Double Peak Double Iron Butterfly Spread is pretty straight forward and is pretty much just two individual Iron Butterfly Spreads placed on the same stock. This is unlike the Wide Range Double Iron Butterfly Spread where the middle strike prices need to be close to each other. No, the middle strike prices in a Double Peak Double Iron Butterfly Spread is pretty much at any price you want to target and does not have to be together. In fact, this is an options strategy some professional options traders use for trading binary outcomes such as pending take over bids etc. Below is an example of a Double Peak Double Iron Butterfly Spread targetting $86 and $90.

As you can see from the trade calculation above, maximum profit occurs when the price of QQQ hits either $86 or $90.

How To Use Double Peak Double Iron Butterfly Spread?

Basically, the Double Peak Double Iron Butterfly Spread is just putting on two individual Iron Butterfly Spreads with middle strike prices on two individual prices you wish to target. The exact trade made in the example above was:

Double Peak Double Iron Butterfly Spread Example |

||||

| Iron Butterfly Spread 1 | ||||

| Order | Amount | Contract | Unit Price | Cost |

| Buy to Open | 5 | QQQ Jan87Call | $1.15 | $575 |

| Sell to Open | 5 | QQQ Jan86Call | $1.80 | ($900) |

| Sell to Open | 5 | QQQ Jan86Put | $0.50 | ($250) |

| Buy to Open | 5 | QQQ Jan85Put | $0.33 | $165 |

| Iron Butterfly Spread 2 | ||||

| Buy to Open | 5 | QQQ Jan91Call | $0.06 | $30 |

| Sell to Open | 5 | QQQ Jan90Call | $0.12 | ($60) |

| Sell to Open | 5 | QQQ Jan90Put | $2.85 | ($1425) |

| Buy to Open | 5 | QQQ Jan89Put | $2.02 | $1010 |

Choice of Long Legs for Double Peak Double Iron Butterfly Spread

The consideration for choosing long legs for Double Peak Double Iron Butterfly Spread is the same as the Wide Range Double Iron Butterfly Spread. The further the strike prices of the long legs from the short legs, the higher the maximum profit becomes with higher maximum loss and a wider breakeven range. Conversely, the nearer the strike prices of the long legs from the short legs, the lower the maximum profit becomes with lower maximum loss and a narrower breakeven range.

Trading Level Required For Double Iron Butterfly Spreads

A Level 4 options trading account that allows the execution of credit spreads is needed for the both Double Iron Butterfly Spreads. Read more about Options Account Trading Levels.

Profit Potential of Double Iron Butterfly Spread :

Double Iron Butterfly Spreads achieve their maximum profit potential at expiration if the price of the underlying asset falls on the short middle strike price of either of the two Iron Butterfly Spreads.

Advantages of Double Iron Butterfly Spread:

:: Able to target multiple prices

:: Maximum loss and profit are predictable.

Disadvantages of Double Iron Butterfly Spread:

:: Larger commissions involved than simpler strategies with lesser trades.

:: Not a strategy that traders with low trading levels can execute.

Adjustments for Double Iron Butterfly Spreads Before Expiration :

1. If the underlying asset has gained in price and is expected to continue rising, you could close out all the call options and

transform the position into a Double Bull Put Spread.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by