How Does Reverse Iron Butterfly Spread Work in Options Trading?

Purpose Of Reverse Iron Butterfly Spread

1. To Profit From Stocks Expected To Go Up Or Down Quickly

Expectations Of Reverse Iron Butterfly Spread

Type Of Spread

How To Use Reverse Iron Butterfly Spread?

There are 4 option trades to establish for this strategy : 1. Sell To Open X number of Out Of The Money Call Options. 2. Buy To Open X

number of At The Money Call Options. 3. Sell To Open X number of Out Of The Money Put Options. 4. Buy To Open X number of At The Money Put Options.

Sell OTM Call + Buy ATM Call + Buy ATM Put + Sell OTM Put

Profit Potential of Reverse Iron Butterfly Spread :

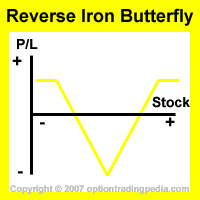

Reverse Iron Butterfly Spreads achieve their maximum profit potential at expiration if the price of the underlying stock exceeds the upper or lower breakeven point.

Profit Calculation of Reverse Iron Butterfly Spread:

Maximum Profit = Greatest Difference In Strike - Debit

Maximum Loss Possible = Net Debit

Risk / Reward of Reverse Iron Butterfly Spread:

Upside Maximum Profit: Limited

Break Even Points of Reverse Iron Butterfly Spread:

Upper Break Even Point = Long Call Strike + Debit

Lower Break Even = Long Put Strike - Debit

Advantages Of Reverse Iron Butterfly Spread:

Disadvantages Of Reverse Iron Butterfly Spread:

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by