What does legging in options trading mean? What does it mean to leg into a trade? How does legging give you a better return?

Legging in Options Trading - Introduction

Legging is one of the most important options trading technique used by position traders who trades complex options strategies.

Complex options strategies consist of multiple strike prices, expiration and options, making it extremely difficult for them to be established as a single position simultaneously. This is where the skill of legging come in.

What Is Legging in Options Trading?

Buying a single call option or put option requires you to only buy one specific call option or put option contract in order to establish a position. This is the most straight forward form of options trading and requires no legging as the position consists of only 1 leg. However, complex options trading strategies like the Butterfly Spread consists of many different options put together into a single position and it may not be possible or profitable to execute all of the different "legs" simultaneously. As such, position traders buy or short the individual options that make up such strategies individually, seperately, instead of simultaneously. This is known as "legging" into a position.

What is a Leg?

Legging comes from the singular term "leg", which means a component that makes up an options trading strategy. This is why putting on each leg individually is known as "legging".

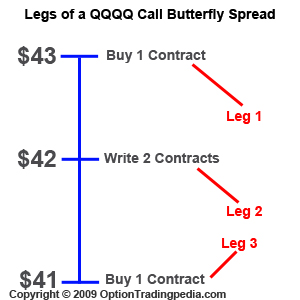

Complex options strategies are made up of multiple "legs". For instance, a Butterfly Spread consists of 3 legs; Buy Out of the money Options, Buy In the Money options and Write At the Money options. A Call Butterfly Spread on the QQQQ might look like the picture below:

|

|

As you can see from the picture above, each part of the butterfly spread is known as a leg no matter how many contracts are involved in each leg. Putting on the 3 parts of the position seperately is known as "legging" into the position.

What is the Purpose of Legging in Options Trading?

There are 2 purposes for legging into an options trading position; 1, because some brokers do not fill whole positions simultaneously. 2, to make a position profitable or to increase potential profits.

In the past, when there were only phone brokers, there is no way you can call your broker and say that you want a "QQQQ Butterfly Spread centered on $42" to be put on at all. You need to tell your phone broker one by one each leg that you want established. Those were the times when legging into a position is extremely important to ensure profitability and to ensure that the position is filled correctly. With the advent of online options trading brokers, more and more brokers are offering functions where you can fill whole complex positions simultaneously, making the purpose of filling whole positions through legging less important. These days, where whole positions can be filled simultaneously at a click of a mouse, legging became a technique used by veteran options traders for increased profitability or to make profitable positions that are rarely profitably due to commissions.

Taking the QQQQ Butterfly Spread position above as an example. Assuming that the $42 calls are quoted at 1.2/1.25, the $43 calls are quoted at 0.5/0.55, and the $41 calls are quoted at 1.4/1.45. The maximum profit of the position would be ($1.20 x 2) - ($0.55 + $0.40) = $1.45. However, through legging into this position and filling the $42 at $1.30, the $43 call at $0.50 and the $41 call at $1.40, the maximum profit of the position would be ($1.40 x 2) - ($0.50 + $0.40) = $1.90. See the drastic difference?

Who Should Use Legging?

At this point, it must be made clear that legging can also be risky and it should only be undertaken by experienced options traders who are familiar with intraday price trends and are quick at calculating the net effects of different prices on their positions on the fly. We will be covering the risks of legging in options trading below. Legging is NOT for beginners to options trading.

How To Perform Legging in Options Trading?

The fact in the market is that prices are moving constantly, both options and stock prices. Especially when it is moving strongly in one direction, prices of some legs may be very different by the time you come to executing those legs. When the prices have moved far enough to eradicate the possibility of profiting from the strategy, you are deemed to have been legged out and is left with an incomplete position which might work against you. That is the risk of legging into a position.

The key to successful legging is Priority. How you prioritize your legging in terms of which leg to execute first followed by which leg is pivotal to successful legging. As such, understanding the prevailing market condition becomes crucial to successful legging. If the prevailing market condition is relatively stagnant where the stock price isn't really moving, then the priority of execution may not be extremely important but when the prevailing market condition is inclined in one direction, having a wrong priority might get you a good price for your first execution and then all the wrong prices for the subsequent legs, totally destroying the profitability of the position.

|

|

Once you have determined the prevailing market condition, it is time to plan your course of action. In order to figure out the priority in which to execute each leg of the position, you need to understand the "ease" of making each leg in the prevailing market condition and then make the hard trades first.

Legging In A Rising Market

In a rising market, it will be harder to buy call options than sell call options because rising prices are favorable for selling options but makes it harder to get a good price when buying options. As such, you would endeavor to execute long call option legs first under such conditions so that you can seal in the better prices earlier and then work on the easier legs.

In our QQQQ Butterfly Spread example above, we would endeavor to buy both the $41 and $43 long call options legs first in a rising market as that will enable us to seal in the favorable lower price early. After those legs are bought, we can then write the $42 short leg for the better higher price. Lets see how that works out:

|

Legging into QQQQ Butterfly Spread in Rising Market

Prices before market open: $41 Call : 1.4/1.45 | $42 Call : 1.2/1.25 | $43 Call : $0.5/$0.55 Market opens strongly and prices started moving upwards. You buy to open the $41 call at $1.50 and the $43 Call at $0.55. Following which, you sell to open the $42 call at $1.30. The maximum profit attainable by legging into this position will be: ($1.30 x 2) - ($0.40 + $0.55) = $1.65 |

As you can see above, legging into the hard legs first allows the subsequent easier leg to gain a better price. This is the importance of priority. To illustrate the importance of priority in legging, lets look at an example of an options trading beginner legging into the same Butterfly Spread on QQQQ with the wrong priority, legging into the easy legs first then the hard leg:

|

Legging into QQQQ Butterfly Spread in Rising Market

Prices before market open: $41 Call : 1.4/1.45 | $42 Call : 1.2/1.25 | $43 Call : $0.5/$0.55 Market opens strongly and prices started moving upwards. You sell to open the $42 call quickly for $1.20. The position filled and the QQQQ has already moved higher. You buy to open the $41 call at $1.60 and the $43 call at $0.60. The maximum profit attainable by legging into this position will be: ($1.20 x 2) - ($0.50 + $0.60) = $1.30 |

A difference in maximum attainable profit of about 27% ($0.35) due to nothing more than the priority of executing each leg of the trade when legging in. See how big that difference is?

Legging In A Falling Market

In a falling market, prices are favorable for all legs with negative deltas which makes them harder to fill at good prices and therefore the hard legs. As such, you would execute the short call legs first before the long call legs. Let's see how that works out in our QQQQ Butterfly Spread example:

|

Legging into QQQQ Butterfly Spread in Falling Market

Prices before market open: $41 Call : 1.4/1.45 | $42 Call : 1.2/1.25 | $43 Call : $0.5/$0.55 Market opens weak and prices started moving downwards. You sell to open the $42 call quickly when market opens at $1.15. Prices have started moving much lower after the $42 call filled. You buy to open the $41 call at $1.30 and the $43 call at $0.4. The maximum profit attainable by legging into this position will be: ($1.15 x 2) - ($0.30 + $0.40) = $1.60 |

Similarly, let's take a look at what happens if the position is legged into the wrong way:

|

Legging into QQQQ Butterfly Spread in Falling Market

Prices before market open: $41 Call : 1.4/1.45 | $42 Call : 1.2/1.25 | $43 Call : $0.5/$0.55 Market opens weak and prices started moving downwards. You buy to open the $41 call at $1.35 and the $43 call at $0.5. Prices have started moving much lower after that and you sell to open the $42 call at $1.10. The maximum profit attainable by legging into this position will be: ($1.10 x 2) - ($0.35 + $0.50) = $1.35 |

Again, see the large difference in maximum profit attainable when an options trading position is legged into the correct way?

Danger of Legging - Getting legged out of position

If your legging priority is wrong and the market is moving strongly, there may come a point where you are simply unable to complete the position as prices have now moved some legs to such unfavorable prices that it is no longer profitable. This is what is known as to be "Legged out of position". Assuming that the market is rising very strongly and you are trying to put on the same QQQQ Butterfly Spread with the wrong priority:

|

Legging into QQQQ Butterfly Spread in Rising Market

Prices before market open: $41 Call : 1.4/1.45 | $42 Call : 1.2/1.25 | $43 Call : $0.5/$0.55 Market opens strongly and prices started moving upwards. You sell to open the $42 call quickly for $1.20. The position filled and the QQQQ has already moved much higher. You buy to open the $41 call at $1.70 and the $43 call at $1.90. The maximum profit attainable by legging into this position will be: ($1.20 x 2) - ($0.50 + $1.90) = $0 |

Of course the example above is an extreme example using hypothetical figures but serves to illustrate what could possibly happen when legging into the position wrongly. When using options trading strategies with extremely slim profit margin, legging into the position correctly and wrongly may make the difference between making a profit and getting legged out of position with trades that serves no purpose at all.

Advantages of Legging in Options Trading

When performed correctly, legging into a position can:

:: Increase maximum attainable profit

:: Make positions with extremely lean profit margin profitable

:: Be absolutely essential in arbitrage

Disadvantages of Legging in Options Trading

When performed incorrectly, legging into a position can:

:: Decrease maximum attainable profit

:: Eradicate possibilities of profit

:: Get you legged out of position and leave you with a position that works against you

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by