How Do Long Gut Spread in Options Trading?

Long Gut Spread - Introduction

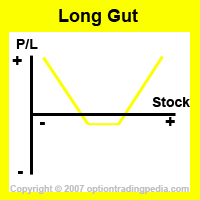

The Long Gut Spread is a volatile options trading strategy designed to profit when the underlying stock moves strongly upwards or downwards.

The Long Gut Spread is a cousin of the Long Straddle and the Long Strangle with the only difference being that In The Money options are used

instead. The Long Gut Spread is useful when

no At The Money options are available when you want to use a Straddle. In fact, since exactly at the money options are so rare,

the Long Gut Spread using in the money options and the Long Strangle using Out Of The Money options are far more commonly used than the

Straddle.

|

|

Straddles, Strangles and Long Guts form the family of basic volatile options strategies and each have their own pros and cons. Here's a comparison table:

| Straddle | Strangle | Long Gut | |

| Max Profit | High | Highest | Low |

| Max Loss | Highest | High | Low |

| Cost of Position | High | Low | Highest |

| Breakeven Points | Narrow | Wide | Widest |

When To Use Long Gut Spread?

One should use a Long Gut Spread when one is confident of a strong move in the underlying asset but is uncertain as to which direction it may be. Situations that creates an uncertainty as to the direction of move may be just before an important corporate announcement, court verdict, earnings announcement etc...

How To Use Long Gut Spread?

Establishing a Long Gut Spread simply involves the simultaneous purchase of an in the money (ITM) call option and an in the money (ITM) put option on the underlying asset. In the money call options give you unlimited profit to upside when the stock moves higher with limited loss to down side while in the money put options give you unlimited profit to downside when the underlying stock moves lower with limited loss to upside. Combine them both and you will have a Long Gut Spread which profits when the underlying stock moves up or down. This strategy makes full use of the unlimited profit and limited risk characteristics of stock options.

|

Long Gut Spread Example :

Assuming QQQQ at $44. Buy To Open QQQQ Jan43Call, buy To Open QQQQ Jan45Put |

You would notice immediately that

the components and concept for Long Gut Spreads are exactly the same as a Straddle or Strangle with the only difference being that

in the money options are used instead. You would notice immediately that

the components and concept for Long Gut Spreads are exactly the same as a Straddle or Strangle with the only difference being that

in the money options are used instead.

|

Trading Level Required For Long Gut Spread

A Level 2 options trading account that allows the buying of both call options and put options is needed for the Long Gut Spread. Read more about Options Account Trading Levels.

Profit Potential of Long Gut Spread :

Long Gut Spreads profit in 2 ways. Firstly, if the stock goes up, the long call option goes up in price along with the stock price while the Long put option eventually expires out of the money. Secondly, if the stock goes down, the Long put option goes up in price along with the drop in the stock price while the Long call option eventually expires out of the money. This results in unlimited profits to upside and downside.

Profit Calculation of Long Gut Spread:

Maximum Profit = Unlimited.

Profit % If Stock Goes Up = [(Price Of Stock At Expiration - Call Options Strike Price) - Net Debit Paid] / Net Debit Paid

Profit % If Stock Goes Down = [(Put Options Strike Price - Price Of Stock At Expiration) - Net Debit Paid] / Net Debit Paid

Maximum Loss Possible = Net Debit Paid - (Strike Price of Long Put - Strike Price of Long Call)

|

Long Gut Spread Example Continued :

Bought the JAN 43 Call for $1.50, Bought the JAN 45 Put for $1.60 Assuming QQQQ close at $50 at expiration. Maximum Loss Possible = 3.10 - (45 - 43) = $1.10 |

Risk / Reward of Long Gut Spread:

Upside Maximum Profit: Unlimited

Maximum Loss: Limited to calculated maximum loss

Break Even Points (Profitable Range) of Long Gut Spread:

Long Gut Spreads are profitable as long as the price of the underlying stock exceeds either the upper or lower breakeven point.

|

Net Debit=$3.10 , Call Strike = $43.00

Upper Breakeven Point = $43.00 + $3.10 = $46.10. |

Lower Break Even = Put Strike - Net Debit

|

Net Debit = $3.10 , Put Strike = $45.00

|

Advantages Of Long Gut Spread:

Disadvantages Of Long Gut Spread:

Alternate Actions for Long Gut Spreads Before Expiration :

1. If the underlying asset has moved beyond its breakeven point and is expected to continue to move strongly in the same direction,

one could sell the out of the money option so that some value is recovered from it.

2. If one is very aggressive and confident that the underlying asset will continue to move strongly in the same direction, one could

then use the money gained from selling the

out of the money option, and buying more contracts of the in the money option.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by