What are Married Puts in Options Trading?

Purpose Of Married Puts

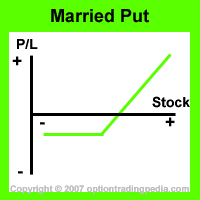

To create a stock position with limited downside but unlimited upside potential.

Expectations of Married Puts

Bullish

Type of Spread

How To Use Married Puts

Buy to open 1 contract of at the money put options for every 100 shares that you own.

Buy ATM Put

Profit Potential of Married Puts :

Married Puts is an option trading hedging strategy which, combined with the underlying stock, grants unlimited maximum profit as long as the underlying stock continues to rise.

Profit Calculation of Married Puts :

Profit = (stock price - put strike price - cost of put) x number of shares

Risk / Reward of Married Puts:

Upside Maximum Profit: Unlimited

Break Even Point of Married Puts:

Breakeven = Initial stock price + cost of put options bought.

Advantages Of Married Puts:

Disadvantages Of Married Puts:

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by