What Are Options Chains & How To Read Them?

Options Chains - Introduction

Just as you get prices of stocks from a stock quote, you get prices of stock options from options chains in options trading.

Options chains are tables that outline all the available options of a particular optionable stock and is presented in a few different ways. Learning to read options chains

properly is the first skill all beginners to options trading should master and is also one of the most confusing to start with.

Types of Options Chains

There are actually several popular formats for options chains which presents various options information. Here is a list of commonly found formats:

1. Basic Call and Put Options Chain

This is the most basic options chain and one which most options traders deal with. This is the format which presents both call and put options of

various strike prices on one screen. Information presented include Open Interest, Bid / Ask / Last price, Options Symbol and volume.

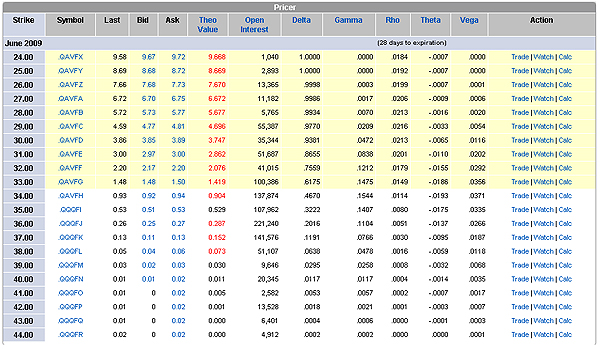

2. Call / Put Options Pricer

This is a more detailed options chain which presents all the basic information that the Basic Options Chains do and also the options greeks. Only

Call options or Put options are presented on one screen.

This is a processed options chain that presents details of options involved in specific options strategies. For example, a covered call options chain would present the net debit of the covered call position at various call options strike prices along with additional information such as static return and assigned return.

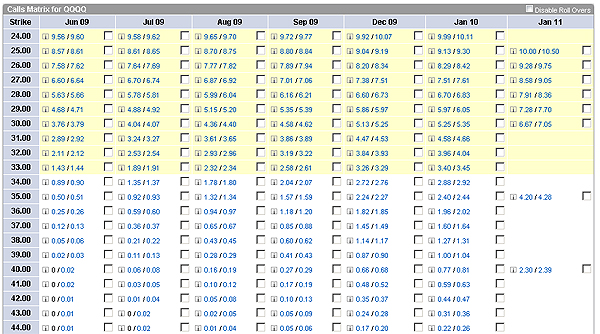

4. Call / Put Options Matrix

A call or put options matrix aims to present as many strike prices and expiration months all on one page and is useful for options traders who using both long term and short term options in a single options trading position.

Basic Call and Put Options Chains

This is the most common options chain that all options trading beginners need to learn. The Basic Call and Put options chains presents a split table with call options to the left and put options to the right. The various strike prices available runs down the center so that options traders can easily identify call and put options of various strike prices. Please see pic below.

As you can see above, strike prices run through the middle of the options chain with call options on its left side and put options on its right side. The options symbol, bid/ask/last price, price change from last trading day, volume and open interest are presented for both call and put options. This is the options chain most commonly used in options trading as it presents most of the necessary information for simple call and put buying. For options traders employing more complex options trading strategies, the Call / Put Options Pricer would be more appropriate.

Call / Put Options Pricer

The call / put options pricer presents all the information in the basic call and put options chains along with each of the five options greeks. This enables options traders employing delta neutral options trading strategies or arbitrage strategies to make precise calculations on the position and size of position to take. Please see pic below.

As you can see, all five options greeks; Delta, Gamma, Theta, Vega and Rho, are presented in the Call / Put Options Pricer. Due to screen limitation, Options pricers normally presents either call options or put options only.

Options Strategies Chains

For options traders employing standardized options strategies such as the long straddle or the covered call, using specific Options strategies chains would really cut down the work of calculating the outlay and other specifics of the specific options trading strategy. Such options chains present only the various combination of options for a specific options strategy across various strike prices or expiration dates. It automatically calculates the net effect of putting on the position as well as other useful information so that options traders can make a decision on which spread to take quickly without wasting time on the calculation. Please see pic below.

The above picture is an Options Strategies chain for Covered Calls on the QQQQ. As you can see, the options strategies chain presents the net cost of the strategy at various strike prices as well as other information.

Call / Put Options Matrix

So far, this is the options chain least used by amateur or retail options traders. This options chain aims to present as many options and their bid/ask prices across as many expiration dates as possible all on one page. Below is a Call Matrix for the QQQQ.

As you can see above, Options Matrix presents only the bid and ask prices of each option listed without any other information and is therefore the least useful for retail investors so far.

|

Can't Decide Which Options Strategy To Use? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by