|

Options Strategies for 2017? What Works?

Have no doubts about it, 2017 is going to be a very tough year...

By tough, I don't mean its going to be a market crash for that would be too simple a scenario to profit from as an options trader, right? Nothing tough about that. By tough, I mean

uncertainty. Uncertainty caused by:

1. The stock market missing its best chance at a market reset (crash) in 2016, so now every step upwards only builds up on the possibility of a catastrophic collaspe, making it hard to

stay out but at the same time, hard to be completely bullish. Are there options strategies which could offset this risk?

2. A new era with President Donald Trump. So far, the stock market seems to like him so much as to continue rallying somewhat irrationally. So far, most of his intended policies have

largely unknown impact on the US economy even though he is aggressively pro-American business, which should spell good news for the US economy and therefore the stock market, the uncertainties

cannot be completely ignored and which makes risk hedging ever more important. Are there options strategies that could protect our portfolio as we cautiously participate in this rally?

3. I am of the opinion that this year would end positively, but not without significant volatility along the way (Read my 2017 Outlook Report). Are there options strategies that could profit in such a volatile condition and still stay bullish inclined in order to reap the eventual reward?

Indeed, it is exactly under such uncertain conditions that the value of options trading truly shines through. In order to participate in and profit from such a market condition, it has become mandatory even for stock traders to learn how

to hedge risk and profit in multiple market directions through the use of options or risk missing out on the rally or risk getting obliterated in a sudden market correction or risk simply not making any money if the market

decides to go sideways for an extended period of time.

Indeed, no other financial instruments provide the flexibility and versatility that only options can through the use of options strategies; the ability to protect against downside loss to your stock portfolio without limiting

the upside profitability, the ability to profit in completely sideways markets and even to profit from more than one direction in uncertain market conditions. Sounds like the perfect solution for the kind of market condition

in 2017? This article will explore a few simple options strategies for 2017 that can be used to achieve these investment objectives. For a full list of options strategies, please refer to our Options Strategy Library.

Under such an outlook, here are my top options strategies for 2017:

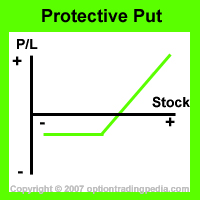

Options Strategies for 2017 - Protective Put / Married Put

Do you wish to protect the value of your stock portfolio from dropping while still being able to profit if the stock/s go upwards?

Top of the list is definitely the most common options strategy used for protecting the value of a stock portfolio; the Protective Put or sometimes also known as a Married Put. In fact, this options strategy is as good as purchasing an INSURANCE for your stocks! Yes, you could buy

this "insurance" to protect your stocks at a certain price so that if it drops below that price, the value of your portfolio would not drop at all! Yes, it sounds too good to even be legal, right? But it is! When options

were first launched in the options market, it was intended to be used as a hedging tool and this is the options strategy that you could use to completely hedge your stocks from any downside beyoud a price that you set,

exactly like buying insurance for your stocks! If you are a stock investor, holding stocks for the long term, you would definitely need to use this strategy in order to protect your portfolio from any sudden drops that

might happen due to the various policies that President Trump is and will be signing off in office that may affect certain industries or companies adversely.

Protective Put - How to?

Just like what the name suggests, a Protective Put is simply buying put options in order to protect the value of its underlying stock. Its simply "Marrying" a put option onto stocks, hence the name "Married Put".

How it works is that put options INCREASE in value as the price of the underlying stock DROPS. So, by buying put options on the strike price beyond which you wish to "insurance" your stocks from dropping further,

If the stock does drop suddenly, the value of the put options would rise in the exact amount dropped by the underlying stock beyond the strike price chosen.

Protective Put Example :

Assuming you own 100 shares of XYZ at $40 and you wish to make sure your account value do not drop if XYZ falls below $40. This

is when you can simply buy to open 1 contract of XYZ $40 strike price put options (For perhaps $1 x 100 = $100) in order to buy "insurance" for your XYZ stock at $40!

Assuming XYZ company got hit by an unforeseen scandal and its stock price drops from $40 to $10. Even though you would lose $40 - $10 = $40 x 100 shares = $3000,

your put options value would actually rise to $40 - $10 = $30, making you a $30 x 100 = $3000 profit (less the $100 premium paid for "insurance"), completely offsetting the $3000

loss on the stocks, thereby insuring you against the loss and protecting the value of your portfolio. You only lose the $100 premium paid for "insurance" through the put options.

|

Read the full tutorial on Protective Puts now!

Options Strategies for 2017 - Fiduciary Call

Now, what if you are not a stock trader and you don't have any stocks at all, you don't wish to purchase the stocks at all, but you still wish to profit to the upside as if you bought the underlying stocks and still

not loss more money than you intend to, just like you have bought protective puts on those stocks?

This is when Call Options come into play. So, instead of buying 100 shares of the underlying stock, you could simply buy 1 contract of the call options of the underlying stock and still reap the same reward as you

would if the stock goes upwards as if you actually own the underlying stocks themselves and yet, if the stock plunges suddenly, you would lose only the options premium paid on the call options as if you had a Protective

Put on actual stocks! If you wish to buy only 10 shares of the underlying stock, you could instead buy 1 contract of its Mini Options representing 10 shares of the underlying stock for a small options premium which is

only a fraction of the cost of the stocks itself. This why this options strategy is known as a "Fiduciary Call". This means replacing the original intention of buying the stocks with buying the same amount of call

options instead at just a fraction of the price.

This is again an extremely useful options strategy in the uncertain market conditions of 2017 where you wish to profit to upside but yet be protected against any sudden and catastophic drops in price. It has the exact

same effect of the Protective Puts above but just without having to buy the underlying stock at all.

Fiduciary Call Example :

Assuming you wish to invest in 100 shares of XYZ at $40 for 1 month but do not wish to spend all $4000 just to buy the stock itself

and you wish to make sure your account value do not drop if XYZ falls below $40, you lose no more than a 6 months premium that you would have used

towards buying a protective put on it.

This is when instead of spending $4000 on buying 100 shares of XYZ stocks, you can simply buy 1 contract (representing 100 shares) of XYZ $40 strike price call options (For perhaps $1 x 100 = $100).

Assuming XYZ company got hit by an unforeseen scandal and its stock price drops from $40 to $10. You would have lost $40 - $10 = $40 x 100 shares = $3000 if you bought the shares but

because you only bought the call options, you only lose the premium you paid for the $40 strike price call options, which is $100, nothing more, just like in the Protective Puts scenario above.

|

Now, the key to this strategy is to only buy as much options as you would have the underlying stocks. So, if you intended initially to only buy 100 shares of the underlying stock, please do not be

tempted to buy 2 contracts or more of the underlying call options as that would represent 200 or more shares, which would be overleveraging and not in the spirit of using a Fiduciary Call. (Similarly,

if you intend to only buy 10 shares of the underlying stock, please do not be tempted to buy more than 1 contract of its mini options.) Remember, a Fiduciary Call options strategy is a way of replacing

stocks with options 1 for 1.

Read the full tutorial on Fiduciary Calls now!

Options Strategies for 2017 - Covered Call

What if the market started going slightly bearish sideways on some uncertain 2017 policies released by the new President and you are holding stocks which you hope to still make a profit on even if it goes sideways and

also be protected if it should go down a little bit?

Yes, you can do that too using a very simple yet popular options strategy known as the "Covered Call". Covered Call is like collecting monthly or weekly rental on your stocks even if the price of the stocks go nowhere!

Yes, its like collecting dividends but every week or month rather than every quarterly! This would enable you to still make a profit even if the market decides to go into one of those slightly bearish sideways channel like

the Dow Jones Industrials 30 did from mid December 2016 to mid January 2017.

A Covered Call is simply the sale of call options covered by the ownership of the underlying stocks itself. This means that you are playing "Banker" by selling call options to people who wants the right to buy your

stocks at the price designated in the call options you sold. So, how then would you still be able to keep your stock if you gave someone else the rights to buy them from you? Well, the trick is to sell the right to buy

your stocks at a price HIGHER than the actual price of your stocks! So, by the end of the options contract, be it one month or even one week, if the call options remain unexercised, it will expire and you get to keep

the money the person paid you, just like collecting "rent" on your stocks! Why then would anyone buy the rights to buy your stocks at a price higher than the actual price? Well, people would for many reasons, amongst those,

is to speculate that the price of the stock will rally strongly before the end of the contract. This is why this is an options strategy you should use only if you expect the price of the stock to be going sideways for

an extended period of time and you wish to profit from that kind of sideways move. If you expect the stock to be rallying strongly, you won't be doing this.

Covered Call Example :

Assuming you own 100 shares of XYZ at $40 and you wish to make an extra income while the price of XYZ goes sideways. You sell to open 1 contract (representing 100 shares) of

XYZ's 1 month call option at the $43 strike price at $0.50 for a total income of $0.50 x 100 = $50.

Assuming XYZ continued sideways for the month as predicted, below the call options strike price of $43. That gave the buyer of the call options no reason at all to exercise that option

to buy the stocks at $43 when the stock price is lower than that. The call options just expires worthless with the buyer losing the "bet" to you, the "banker". You pocket the $50 as

profit for the month and can continue to do the same in the following month if you think the stock is still going to go sideways.

|

You may have noticed that in this options strategy, unlike the above 2 options strategies, you are actually playing "Banker" by Selling options to other options traders rather than Buying options.

This works pretty much like a bet where the player, who is the one who bought the call options you sold, is betting that the stock would go up while you, the "Banker", provides the odds and keeps

the bet money if the player loses the bet.

Read the full tutorial on Covered Calls now! One way of simulating the returns on a Covered Call without having to buy the underlying stock is by Selling Put Options.

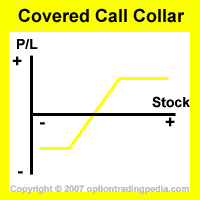

Options Strategies for 2017 - Covered Call Collar

Now, what if you are of the opinion that the stocks that you are holding is going to be largely sideways for the month but due to the possibility unforeseen and unannounced policies made by the new President, you want to

do the Covered Call options strategy but also wish to have the protection of a Protective Put options strategy? This is when the Covered Call Collar options strategy come in!

The Covered Call Collar is simply sacrificing a part of the money earned from selling the call options to buy some cheaper put options in order to protect your stocks from catastophic drop just like in a protective put!

This results in a position in which you are earning money from a sideways moving stock while at the same time protecting it from catastrophic losses! Now, that doesn't even sound legal from an investment point of view,

does it? But its not only legal but completely possible through the power of options!

Covered Call Collar Example :

Assuming you own 100 shares of XYZ at $40 and you wish to make an extra income while the price of XYZ goes sideways. You sell to open 1 contract (representing 100 shares) of

XYZ's 1 month call option at the $43 strike price at $0.50 for a total income of $0.50 x 100 = $50. To protect XYZ from a catastrophic drop below $35, you use $0.30 from the sale of the

call options towards buying XYZ's 1 month put option at the $35 strike price for a net profit of $50 - $30 = $20.

Assuming XYZ continued sideways for the month as predicted, below the call options strike price of $43. That gave the buyer of the call options no reason at all to exercise that option

to buy the stocks at $43 when the stock price is lower than that. The call options just expires worthless with the buyer losing the "bet" to you, the "banker". You pocket the $50 as

profit for the month and can continue to do the same in the following month if you think the stock is still going to go sideways.

Assuming XYZ dropped suddenly to $20. The call options you sold will expire worthless as the buyer loses the "bet" so you pocket the $20 net profit from the sale of the call options

and the buying of the put options. Now, you could exercise the put options in order to still sell your XYZ stock at $35 even though it has dropped to $20, hence the insurance!

|

Read the full tutorial on Covered Call Collar now!

The good thing about these options strategies is that they require only very low account / trading levels to execute through reputable online options brokers such as Optionsxpress.com.

|