What Are Synthetic Short Straddle and Synthetic Short Call Straddles?

Synthetic Short Straddle - Definition

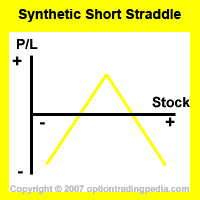

A combination of stocks and call options which produces the same payoff characteristics as a Short Straddle options trading strategy.

What Is Synthetic Short Straddle?

Synthetic Short Straddle transforms a basic stock position into an options trading position that profits even when the stock remains stagnant exactly as a short straddle options trading strategy does. This is useful when a stock position you are holding is expected to remain stagnant and you want to profit from it. This is the kind of flexibility that options trading grants through the use of Synthetic Options Strategies.

When To Use Synthetic Short Straddle?

One should use a Synthetic Short Straddle when one's existing stock holding is expected to remain stagnant and wishes to profit from it. (Thereby mimicking the risk profile of a Short Straddle)

How To Use Synthetic Short Straddle?

There are 2 main ways to establish a Synthetic Short Straddle. One way is by selling twice as many At The Money (ATM) call options as you have Long stocks , known as the Short Call Synthetic Short Straddle. The other way is by selling twice as many At The Money (ATM) put options as you have short stocks , known as the Short Put Synthetic Short Straddle.

Making Short Call Synthetic Short Straddle from Long StockExample : Assuming you own 100 shares of XYZ company trading at $40 now. To transform the position into Synthetic Short Straddle, you will Sell To Open 2 contracts (representing 200 shares) of XYZ's $40 call options. |

Making Short Put Synthetic Short Straddle from Short StockExample : Assuming you are short 100 shares of XYZ company trading at $40 now. To transform the position into Synthetic Short Straddle, you will Sell To Open 2 contracts (representing 200 shares) of XYZ's $40 put options. |

At this point, experienced options traders would notice that establishing a Synthetic Short Straddle actually creates a Delta Neutral Position.

Making Short Call Synthetic Short Straddle from Long StockExample : Assuming you own 100 shares of XYZ company trading at $40 now. To transform the position into Synthetic Short Straddle, you will Sell To Open 2 contracts (representing 200 shares) of XYZ's $40 call options. 100 shares = 100 delta. Short 200 ATM Call Options = -100 Delta (-0.5 delta each). Total Delta = 100 - 100 = 0 |

Making Short Put Synthetic Short Straddle from Short StockExample : Assuming you are short 100 shares of XYZ company trading at $40 now. To transform the position into Synthetic Short Straddle, you will Sell To Open 2 contracts (representing 200 shares) of XYZ's $40 put options. 100 short shares = -100 delta. Short 200 ATM Put Options = 100 Delta (0.5 delta each). |

Profit Potential Of Synthetic Short Straddle

Synthetic Short Straddle reaches maximum profitability when the underlying stock closes exactly at the strike price of the short options.

Risk / Reward Of Synthetic Short Straddle

Maximum Profit: Limited

Maximum Loss: Unlimited

Breakeven Point Of Synthetic Short Straddle

There are 2 break even points to a Synthetic Short Straddle. One breakeven point if the underlying asset goes up (Upper Breakeven), and one breakeven point if the underlying asset goes down (Lower Breakeven). The Synthetic Short Straddle is profitable as long as it remains within the 2 breakeven points.

Lower Break Even = Option Strike Price - Extrinsic Value Of Options

Making Short Call Synthetic Short Straddle from Long StockExample : Assuming you own 100 shares of XYZ company trading at $40 now. To transform the position into Synthetic Short Straddle, you will Sell To Open 2 contracts (representing 200 shares) of XYZ's $40 call options at $1.50. Lower BreakEven = $40 - ($1.50 x 2) = $40 - $3 = $37 |

Advantage of Synthetic Short Straddle

Able to immediately transform a stock position into an options trading position which profits when the position remains stagnant.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by