"Difference Between Selling Put and Covered Put?"

"What's the difference between selling a put vs writing a covered put?"Asked By Robert F. Carangelo on 21 Nov 2011

Answered by Mr. OppiE

Hi Robert F. Carangelo,

Selling a put option, also known as "Naked Put Write", is completely different from writing a "Covered Put" in terms of strategic outlook, capital and margin requirements as well as trading account level. Which means that even though both options strategies involve writing put options, they are really completely different in nature, composition and requirements.

In terms of composition, a Naked Put Write is created simply by writing a put option using the "Sell To Open" order on its own. However, a Covered Put involves writing put options on existing short stock positions so that your short put position is "Covered" in case of an assignment (when the buyer of your put options exercise those put options). As naked put writes are created without any assets covering it, options brokers will require what is known as a "Cash Margin", which is cash deposit in your trading account (Typically a percentage of the amount required to take delivery in case of assignment). However, such cash margin is not required in a covered put as there is a short stock position covering the writing of the puts. Even though margin is not required for writing covered puts, margin is required for maintaining the short stock position.

Assuming AAPL is trading at $374.94 and its December $370 strike price put options are bidding at $11.20.

Example of Naked Put WriteAssuming you write 1 contract of AAPL's Dec370Put at $11.20. Cash proceed from sale of put options = $1,120 Net cash required to put on position = $8,124.80 - $1,120 = $7,004.80 Example of Covered PutAssuming you shorted 100 shares of AAPL and then write 1 contract of AAPL's Dec370Put at $11.20. Cash margin required for shorting 100 shares of AAPL at $374.94 = $37,484.05 (according to optionsxpress short stock margin requirement) Net cash proceed from sale of put options = $1,120 |

Apart from differences in composition and margin requirement, both the naked put write and the covered put also requires different "Trading Levels". Trading level is an options broker's way of restricting the kind of options strategies you can execute in your trading account according to your experience and their risk assessment of your account. Typically, a naked put write requires a level 5 account due to its higher risk of default while a covered put typically requires only a level 2 account as there is no risk of default in the case of an assignment.

Assuming AAPL drops to $110 by December expiration.

Risk Example of Naked Put WriteAssuming you wrote 1 contract of AAPL's Dec370Put at $11.20. You make a cash loss of 370 - 110 = 260 x 100 = $26,000 In this case you may or may not have that much cash to cover such a loss and that is a risk of default for the broker. Risk Example of Covered PutAssuming you shorted 100 shares of AAPL and then wrote 1 contract of AAPL's Dec370Put at $11.20. In case of assignment, the buyer of your put options simply take your 100 shares of short AAPL position so there is no risk of default. |

Finally, the naked put write and the covered put are options strategies with completely different outlooks! In fact, the naked put write is a bullish options strategy while the Covered Put is a bearish options strategy!

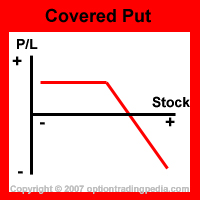

Please compare the risk graph of both strategies below:

|

|

As you can see in the risk graph comparison above, the Covered Put is a bearish options strategy that makes a limited profit when the price of the stock drops and an unlimited loss when the price of the stock rallies while the Naked Put Write is a bullish options strategy that makes a limited profit when the price of the stock rallies and an unlimited loss when the price of the stock drops! Yes, both the Covered Put and the Naked Put Write profits in completely different directions! As such, both strategies are completely different and cannot be regarded as replacements for each other.

The huge difference in strategic outlook is due to the short stock position in the Covered Put position. In a naked put write, as long as the price of the underlying stock remains higher than the strike price of the put options, the writer makes the full premium as profit no matter how high the stock goes. This gives the naked put write its limited profit to upside.

In the AAPL example above, as long as AAPL remains above the put options strike price of $370, you will make the whole $11.20 premium as profit no matter how high AAPL ends up by expiration. There can be no more profit above $11.20 as that is the amount you sold the put options for.

However, if the stock drops, the price of the put options sold will become higher and higher as the price of the stock decreases, resulting in unlimited losses to downside as you will need to buy the put options back at an increasingly higher price than you sold it for.

As you can see from the second example of the AAPL position above, the more AAPL stock drops, the more the value of its Dec370Put increases and the higher the loss becomes as you would now have to buy the put options back at the new higher price in order to close the position.

However, when you add a short stock position to a naked put write creating a covered put, the price of the short stock will decrease as the price of the stock decreases, resulting in a profit that offsets the loss in the put options. In fact, the short stock position would have profited on the downside journey to the strike price of the put options before the price of the stock drop dollar or dollar with the increase in price of the put options, thereby completely offsetting the loss on the put options. This produces a net limited profit to downside for the covered put rather than a loss.

In the AAPL example above, when AAPL drops to $110, the short stock position will gain a profit of $374.94 - $110 = $264.94 while the put options will make a loss of $370 - $110 = $260. This results in a net profit of $264.94 - $260 + $11.20 = $16.14 instead of a loss if you had only owned the puts without the short AAPL stock position.

However, when the price of the underlying stock increases, the covered put will start to make an unlimited loss due to the price of the short stock rising, giving it its unlimited loss to upside.

In the AAPL example above, if AAPL rises to $400 by expiration, the short stock position will make a loss of $400 - $374.94 = $250.60 while the short put options would only have made $11.20 no matter how high AAPL rises to. This resulted in a net loss of $250.60 - $11.20 = $138.60 instead of the $11.20 gain if you had owned only the short puts without the short stock.

Do you see now how adding a short stock position to a naked put write position completely reverses its profit/loss dynamics? In fact, writing out of the money put options is an extremely unique options strategy on its own while the covered put is used mainly as a hedging strategy for a short stock position.

In conclusion, even though both the Naked Put Write and the Covered Put involves writing put options, they are completely different in terms of strategic outlook, composition and account requirements. As such, they should not be regarded as replacements for each other as both options strategies serve completely different purposes.

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by