What is extrinsic value in options trading? How does extrinsic value affect the price of an option?

Extrinsic Value - Definition

The part of a stock option's price above the option's intrinsic value arising from other factors such as implied volatility and length of contract.

Extrinsic Value - Introduction

Extrinsic Value, also not-so-accuratedly known as "Time Value" or "Time Premium", is the real cost of owning a stock options contract. It is the part of the price of an option which the writer of the option gets to keep as profit should the stock remain stagnant all the way to expiration. As such, extrinsic value is actually compensation to the writer of an option for undertaking the risk of writing an option. Extrinsic value is also the part of the price of an option that decreases as time goes by through a phenomena known as "Time Decay" in options trading.

How is Extrinsic Value Calculated?

To completely understand the concept of Extrinsic Value, one must first be familar with what options moneyness is. Options moneyness is an extremely important concept in options trading that directly affects how extrinsic value is calculated.

The intrinsic value of a stock option is the built in value due to how much the option is in the money.

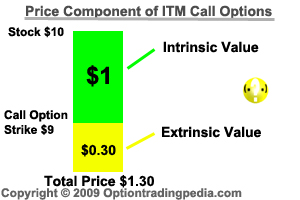

The picture below depicts the price component of an In The Money Call Option.

The stock price in the example above is $10 while the strike price of the call option is $9. As the Call option allows its holder to purchase the stock at $9 when the stock is trading at $10, there is a $1.00 value built in or intrinsic value. As such, out of the total price of $1.30 for the call option above, $1 is intrinsic value while $0.30 is extrinsic value.

Out of the money options, which are options with no built in value, would consist of only extrinsic value. This means that if the option remain out of the money during expiration, it will be totally worthless and the writer of the option would make the extrinsic value that you paid for as profit.

In short, In the money options would contain both intrinsic value and extrinsic value while out of the money options would contain only extrinsic value because there are no built in value in the option at all. All options have extrinsic value while only in the money options have intrinsic value. Buying options with only extrinsic value is like buying a lottery ticket. If the ticket didn't win, you lose whatever money you paid for the ticket. Similarly, if the stock did not move in your favor if you bought an out of the money option with only extrinsic value, the option will become worthless (expire worthless) by expiration and you lose the money you paid for the options contract.

|

|

Formula for Calculating Extrinsic Value from Strike Price and Stock Price

Extrinsic Value of In The Money Call Options = Price of Option - (Stock price - Strike Price)

|

Extrinsic Value of In The Money Call Options:

Assuming stock price = $10, Strike Price = $9, Price of Option = $1.30 Extrinsic Value = $1.30 - ($10 - $9) = $0.30 |

Extrinsic Value of In The Money Put Options = Price of Option - (Strike Price - Stock Price)

|

Extrinsic Value of In The Money Put Options:

Assuming stock price = $10, Strike Price = $11, Price of Option = $1.25 Extrinsic Value = $1.25 - ($11 - $10) = $0.25 |

All at the money and out of the money options contains only extrinsic value and no intrinsic value.

Why Extrinsic Value Is Necessary

Understanding why extrinsic value is necessary takes understanding why anyone would write an options contract in the first place.

Let's assume you own AAPL stocks trading at $100. Why would you write a call option that gives someone else the right to buy those AAPL shares from you, for say $100 (strike price), when you can simply just sell the shares if you want to? What is there to gain? First of all, why would you give anyone any rights to do anything for no compensation at all? This compensation, this fee for the option you are writing, is the extrinsic value.

If AAPL went up in a world without extrinsic value, the holder of the call option would just exercise his right to buy those shares from you at the strike price and you end up selling your AAPL shares to the holder for no benefit to yourself at all. You allowed someone to buy shares from you whenever that person wants to for nothing in return. If AAPL went down, you lose money on AAPL while the holder of the call option lose nothing since nothing is paid in extrinsic value. In fact, if options had no extrinsic values, everyone would be buying out of the money options for free on every optionable stock and profiting from whichever strikes "lottery" by getting in the money. Does that sound even fair to people who writes options?

Yes, options writers write options for a purpose and that purpose is usually to make a profit from the extrinsic value that buyers of that option pay. Nothing is free in options trading.

Why Extrinsic Value Isn't Time Value

Extrinsic Value has been commonly known as "Time Value" because extrinsic value is generally higher for options with longer date to expiration. This is again to justify the additional risk the writer of the option is undertaking. The longer the time to expiration, the longer the exposure to risk to the options writer. However, even though the amount of "time" left in a stock options contract is a major determinant of Extrinsic Value, extrinsic value is NOT only determined by time.

Extrinsic value answers the question of "How much money justifies the risk the writer of the option is undertaking". This risk is defined in options trading using 4 different criteria and factored into a mathematical options pricing models such as the Black-Scholes Model. Indeed, when someone writes an option, that person's risk is not only limited to how long the person is exposed to the risk of being assigned but also a variety of other risks. The 4 factors that come together to determine extrinsic value are:

1. Time left to expiration (Theta)

2. Changes in interest rate (Rho)

3. Volatility of the underlying stock (Vega)

4. Dividends of the underlying stock

As you can see above, time left to expiration is merely one factor taken into consideration when coming with the extrinsic value of a stock option. As such, labelling extrinsic value as "Time Value" is not entirely accurate. However, it must still be acknowledged that out of the four factors, time to expiration and volatility have the greatest influence on extrinsic value while interest rates and dividends are relatively insignificant.

How Extrinsic Value Justifies the Risk to the Writer and the Benefit of the Holder

As you have learnt so far, extrinsic value puts a price on the risk that the writer of the option undertakes for selling you an option. Conversely, that extrinsic value becomes the price you pay in order to enjoy the benefits of owning the option.

Let's examine how extrinsic value justifies risk undertaken by the writer and benefit received by the holder from the perspective of each of the 4 factors affecting extrinsic value.

Time Left to Expiration

The longer the time to expiration, the longer the writer of the option is exposed to the risk of being assigned as well as the risk of unlimited losses. Yes, when an options trader writes a call option, money is lost as long as the underlying stock keeps rising and if that options trader writes a put option, losses build up as long as the stock keeps falling. This is why the writer of the option needs to be paid more in extrinsic value in order to justify the risk of writing longer term options.

From the holder's perspective, the longer the expiration, the more time the stock have to move in the favor of the holder. That is why it is justifiable for the holder to pay more in extrinsic value for options with longer expiration.

Changes in interest rate

This is a slightly more complex issue but here's a simplified explanation. When a person owns shares, that person can either sell those shares right now and keep the cash in a bank account in order to earn interest, or that person can write call options granting the right to buy those shares to the holder of the call option. Since the holder of the call options is given the right to buy the shares at the strike price by expiration, the writer of the call option is actually delaying the sale of the shares, hence giving up the interest that he or she might earn by selling the shares right now. This interest given up by the writer is compensated for in the extrinsic value. The longer the time to expiration and the higher the prevailing interest rate, the higher the extrinsic value will be.

From the holder's perspective, buying options instead of the stock allows money that would otherwise be invested in the stock to be placed into an interest paying account hence justifying a slightly higher extrinsic value due to the extra interest earned.

Volatility of the Underlying Stock

A volatile stock is a stock that is expected to make big up or down moves. Such a stock can suddenly move significantly against the favor of the writer of the option, resulting in significant losses. As such, the higher the implied volatility of a stock, the higher the extrinsic value will be in order to compensate the writer of the option against such a risk.

Buyers of options love volatility. Which is why some people say options trading is all about volatility. Greater volatility translates into greater chance of the stock moving very quickly and strongly in your favor. Such a benefit, justifies a higher extrinsic value for options on such explosive stocks.

Dividends of the underlying stock

Extrinsic value of call options would be lower for dividend paying stocks due to the fact that the price of the stock would be lower by the dividend amount when dividends are declared. When the owners of a stock write call options on dividend stocks that they own instead of selling the stocks outright, they get to keep the dividend paid by the stock, which is then fair for the extrinsic value of the call options to be lower due to this benefit.

Conversely, because the price of the underlying stock is expected to go down by the dividend amount after dividends are declared, it is fair for holders of the call options to pay a lower extrinsic value to reflect this disadvantage. Another justification for a lower extrinsic value is that by owning call options instead of the stock itself, holders of call options are at a slight disadvantage as they do not receive the dividends paid.

Pricing Extrinsic Value

As you have learnt above, there are more than just one factor taken into consideration when coming up with the extrinsic value of an option. Options pricing models such as the Black-Scholes Model and the Binomial Model are used to price the extrinsic value of options. Whenever an options trader say an option's extrinsic value is "high", it usually means that it is higher than the theoretical value determined by the Black-Scholes Model.

Indeed, what these options pricing models do is to come up with a theoretical price of an option which may not be what the option is really trading for. In reality, extrinsic value is determined by market makers on the fly, rising as buying increases and falling as buying decreases. Market makers increase extrinsic value in order to maximize profits due to "increased volatility".

As the Black-Scholes Model is designed for the pricing of European Style Options, American Style Options will always be slightly more expensive than the theoretical values produced by the Black-Scholes Model.

Characteristics of Extrinsic Value

Rate of Extrinsic Value Time Decay

Contrary to popular belief, Time decay of extrinsic value do not occur linearly. Extrinsic value of at the money options decay exponentially faster as expiration date draws nearer while extrinsic value of out of the money options decay fastest during their first few months and then slow down all the way to expiration.

Extrinsic Value and Options Moneyness

Extrinsic value also vary according to options moneyness. At the money options have the highest amount of extrinsic value and the extrinsic value reduces as the option goes more and more in the money or out of the money. As you can see from the call options chain below, the nearest the money option, being the $44 strike has $0.46 of extrinsic value while the in the money $34 strike has only $0.09 of extrinsic value and the out of the money $46 strike has only $0.06 of extrinsic value. This difference in extrinsic value is due to differences in implied volatility across different strike prices, resulting in a Volatility Smile.

Extrinsic Value of Call Options and Put Options

Extrinsic value of call and put options of the same strike price and same options moneyness is usually different. One reason behind the difference is that even though higher interest rate results in higher extrinsic value for call options, it actually results in lower extrinsic value for put options. Similarly, even though dividends decrease the extrinsic value of call options, it actually increases the extrinsic value of put options due to certainty that the stock would go down. Apart from the mathematical reasons, call and put options of the same stock usually have different extrinsic values because a stock is usually going upwards or downwards. Because of that, investors are usually buying more call options or put options. When that happens, the extrinsic value of that type of option increases due to increased trading.

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by