What is intrinsic value in options trading? How does intrinsic value affect the price of an option?

Intrinsic Value - Definition

The built in value of in the money options.

Intrinsic Value - Introduction

Intrinsic value and extrinsic value are the two components that makes up the price of a stock option. Intrinsic value, or sometimes known as "Fundamental Value", is the value that remains in an option when all of its extrinsic value has diminished due to Time Decay. It is the actual value of a stock that has been built into the price of the option. Understanding of what intrinsic value is and how it makes up the price of a stock option is fundamental knowledge that anyone who wants to start options trading must have. This tutorial shall explain in detail what Intrinsic Value is, how it is important and how it is calculated.

What is Intrinsic Value of Options?

Intrinsic value of options is the value of its underlying stock that is built into the price of the option. In fact, options traders buy stock options for the sake of those options gaining intrinsic value ( Long Call or Long Put options trading strategy).

When you buy call options, you do so because you want to to profit when the stock goes up. When the stock moves higher and higher, more and more of the stock's value gets built into the price of the option in the form of intrinsic value.

Similarly, if you own AAPL's $200 strike price put options when AAPL is trading at $150, those put options would also have a $50 intrinsic value because they allow you to SELL AAPL's shares at $200 when it is trading at only $150.

How is Intrinsic Value Calculated?

To completely understand the concept of Intrinsic Value, one must first be familar with what options moneyness is. Options moneyness is an extremely important concept in options trading and directly affects how Intrinsic Value is calculated.

The intrinsic value of a stock option is the built in value due to how much the option is in the money.

Extrinsic Value of a stock option is the extra money you are paying above the intrinsic value in order to own that option.

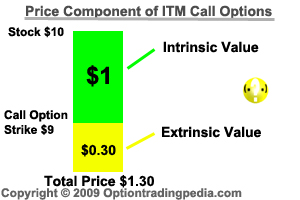

The picture below depicts the price component of an In The Money Call Option.

The stock price in the example above is $10 while the strike price of the call option is $9. As the Call option allows its holder to purchase the stock at $9 when the stock is trading at $10, there is a $1.00 value built in or intrinsic value. As such, out of the total price of $1.30 for the call option above, $1 is intrinsic value while $0.30 is Extrinsic Value.

Out of the money options, which are options with no built in value, would consist of only Extrinsic Value.

In short, In the money options contain both intrinsic value and extrinsic value while out of the money options contain only extrinsic value because there are no built in value in the option at all. All options have Extrinsic Value while only in the money options have intrinsic value.

Intrinsic value will also always be the same for both American style options and European style options.

Formula for Calculating Intrinsic Value from Strike Price and Stock Price

Intrinsic Value of In The Money Call Options = Stock Price - Strike Price

|

Intrinsic Value of In The Money Call Options:

Assuming stock price = $10, Strike Price = $9, Price of Option = $1.30 Intrinsic Value = $10 - $9 = $1.00 In this case, out of the full price of $1.30, $1.00 is intrinsic value while $0.30 is extrinsic value. |

Intrinsic Value of In The Money Put Options = Strike Price - Stock Price

|

Intrinsic Value of In The Money Put Options:

Assuming stock price = $10, Strike Price = $11, Price of Option = $1.25 Intrinsic Value = $11 - $10 = $1.00 In this case, out of the full price of $1.25, $1.00 is intrinsic value while $0.25 is extrinsic value. |

All at the money and out of the money options contains only Extrinsic Value and no intrinsic value.

Characteristics of Intrinsic Value

Do Not Decay Over Time

Unlike extrinsic value, intrinsic value does not diminish or decay over time. It remains stagnant as long as the underlying stock does not move. Options will only be left with their intrinsic value when they expire.

Changes with the Underlying Stock

Intrinsic value changes when the underlying stock moves. Intrinsic value increases as the underlying stock goes more and more in the money and intrinsic value becomes zero when the underlying stock moves out of the money.

Intrinsic Value of Call Options and Put Options

Intrinsic value of call options increases as a stock rises above the strike price of the call options. Intrinsic value of put options increases as the stock falls below the strike price of the put options.

Intrinsic Value Questions

:: Will Put Options Have Intrinsic Value Without Stock Dropping?

:: Why Option Price Below Intrinsic Value?

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by