What is an Iron Condor Spread options strategy? What is its maximum profit and loss?

Iron Condor Spread - Introduction

So, you wish to make a profit even if the price of the underlying stock remain relatively stagnant or within a set price range? This is when you need the Iron Condor Spread!

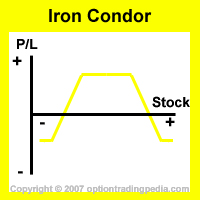

The Iron Condor Spread is without doubt the most popular neutral options trading strategy. Its ability to profit from stocks that are trading within a relatively tight price range has made it a legend to most options trading beginners. The Iron Condor Spread is a complex, advanced neutral option trading strategy built upon the foundation of a Condor Spread and is a high probability and safe way of profiting from a stock that is expected to stay stagnant or trade within a narrow price range.

Studying the Condor Spread first makes the Iron Condor Spread easier to understand.

|

|

Differences between Condor Spread and Iron Condor Spread

1. A Condor Spread consists of only either call options or put options while the Iron Condor Spread consists of both call and put options.

2. The Iron Condor Spread differs from the Condor Spread also in that the Iron Condor Spread results in a net credit whereas executing a Condor Spread results in a net debit. As a complex credit Spread strategy, most online option trading brokers will not allow beginner option traders to put on an Iron Condor Spread due to margin and trading level requiremets. Only veteran traders with high trading levels and a fund big enough to fulfill margin requirements are allowed to put on Iron Condor Spreads. Traders need to check with own brokers as to the criteria needed to allow the trading of credit Spreads or Iron Condor Spreads.

Overall, the Iron Condor Spread is a more advanced option strategy than a Condor Spread that results in better profitability, higher probability of profit and a lower maximum possible loss with the trade off being having to run into margin requirement (You need to have a lot of spare cash in your account before a broker allows you to enter a credit spread such as the Iron Condor Spread).

Here is a table that compares the Iron Condor Spread against similar complex neutral option strategies:

| Condor Spread | Iron Condor Spread | Butterfly Spread | Iron Butterfly Spread | |

| Debit/Credit | Debit | Credit | Debit | Credit |

| Max Profit | Low | High | Higher | Highest |

| Max Loss | Highest | Higher | High | Low |

| Cost of Position | High | NIL | Low | NIL |

| Profitable Range | Wide | Widest | Narrow | Wider |

When To Use Iron Condor Spread?

One should use a Iron Condor Spread when one expects the price of the underlying asset to change very little over the life of the options.

How To Use Iron Condor Spread?

There are 4 option trades to establish for this strategy : 1. Buy To Open X number of far Out Of The Money Call Options. 2. Sell To Open X number of Out Of The Money Call Options. 3. Buy To Open X number of far Out Of The Money Put Options. 4. Sell To Open X number of Out Of The Money Put Options.

Buy Far OTM Call + Sell OTM Call + Buy Far OTM Put + Sell OTM Put

Veteran or experienced option traders would identify at this point that the Iron Condor Spread actually consists of a Bear Call Spread and a Bull Put Spread.

The choice of which strike prices to buy the long legs (trades 1 and 3 above) at depends on the range within which the underlying asset is expected to trade in (Profitable Range). The further away from the money the 2 long legs are, the lower the risk (as the underlying stock needs to move further in order to exit the profitable range), but the higher the maximum loss would be should the profitable range be exited. Again, this is a trade-off that all option traders need to decide and accept when trading any kind of option strategies.

At this point, however, option traders must truly appreciate the level of customisation that the Iron Condor Spread allows. One could literally pre-determine its maximum profit, maximum profit range and maximum risk level in order to attain a position that best suit one's expectations.

|

Iron Condor Spread Example:

Example : Assuming QQQQ trading at $43.57 Buy To Open 1 contract of Jan $45 Call at $0.60 Sell To Open 1 contract of Jan $44 Call at $1.03 Buy To Open 1 contract of Jan $42 Put at $0.59 Sell To Open 1 contract of Jan $43 Put at $0.85 Net Credit = (($1.03 - $0.60) + ($0.85 - $0.59)) x 100 = $69.00 per position |

Contrast this example with the example in Condor Spread.

These examples are made using the same QQQQ on the same strike price and real values. You will see that instead of having to pay $30 per position to put

on the spread (in the case of a Condor spread), you actually get $69 for putting on the Iron Condor Spread. Contrast this example with the example in Condor Spread.

These examples are made using the same QQQQ on the same strike price and real values. You will see that instead of having to pay $30 per position to put

on the spread (in the case of a Condor spread), you actually get $69 for putting on the Iron Condor Spread.

|

Trading Level Required For Iron Condor Spread

A Level 4 options trading account that allows the execution of credit spreads is needed for the Iron Condor Spread. Read more about Options Account Trading Levels.

Profit Potential of Iron Condor Spread :

Iron Condor Spreads achieve their maximum profit potential at expiration if the price of the underlying asset falls within the strike price range bounded by the short call and put options. Maximum profit for the Iron Condor Spread is equal to the net credit gained when the position is put on.

|

Iron Condor Spread Example:

From the above example : Assuming QQQQ close within $44 and $43 at expiration. All 4 legs will expire Out Of The Money and you keep the entire net credit amount. |

The profitability of an iron condor spread can also be enhanced or better guaranteed by legging into the position properly.

Profit Calculation of Iron Condor Spread:

Maximum Profit = Net Credit.

Profit % = (Credit Gained From Short Legs / Greatest Difference In Strike) x 100

Maximum Loss Possible = Difference in strike between long and short strikes - Net Credit

|

Iron Condor Spread Example:

From the above example : Assuming QQQQ close at $43.57 at expiration. Maximum Profit = $69.00 per position. Profit % = [($1.03 + $0.85) / ($43 - $42)] x 100 = 188% Maximum Loss Possible = ($45 - $44) - $0.69 = $0.31 x 100 = $31 per position. |

Notice at this point again that profit is also slightly

higher than a Condor Spread with a tighter maximum possible loss. Notice that we are using a $1 strike difference in these examples, giving us a reward/risk

ratio of 2.2 : 1. ($69 max profit versus $31 max loss) However, if we should use a greater strike difference in order to better ensure our

profitability up to maybe a 40,44,48, our maximum

loss will be much higher and our reward risk ratio will be much lower. That is the trade-off we mentioned earlier on. Notice at this point again that profit is also slightly

higher than a Condor Spread with a tighter maximum possible loss. Notice that we are using a $1 strike difference in these examples, giving us a reward/risk

ratio of 2.2 : 1. ($69 max profit versus $31 max loss) However, if we should use a greater strike difference in order to better ensure our

profitability up to maybe a 40,44,48, our maximum

loss will be much higher and our reward risk ratio will be much lower. That is the trade-off we mentioned earlier on.

|

Risk / Reward of Iron Condor Spread:

Upside Maximum Profit: Limited to net credit gained

Maximum Loss: Limited to calculated maximum loss

Break Even Points (Profitable Range) of Iron Condor Spread:

An Iron Condor Spread is profitable as long as the price of the underlying stock stays within the Profitable Range bounded by the Upper and Lower BreakEven points.

Upper Break Even Point = Short Call Strike + Net Credit

|

Net Credit = $0.69 , Short Call Strike = $44.00

Upper Breakeven Point = $44.00 + $0.69 = $44.69. |

Lower Break Even = Short Put Strike - Net Credit

|

Net Credit = $0.69 , Short Put Strike = $43.00

Lower Breakeven Point = $43.00 - $0.69 = $42.31. |

In this case, the Iron Condor Spread position in our example remains profitable as long as the QQQQ close between $42.31 to $44.69 at option expiration day with maximum profit attained if QQQQ closed at $43.57.

Notice that the Profitable Range of an Iron Condor Spread ($2.38 range) is also wider

than that of a Condor spread ($2.36 range). Notice that the Profitable Range of an Iron Condor Spread ($2.38 range) is also wider

than that of a Condor spread ($2.36 range).

|

Advantages Of Iron Condor Spread:

:: Able to profit on stagnant stocks.

:: Being a credit spread, it reduces overall risk with a higher probability of ending in a profit than a debit spread.

:: Maximum loss and profits are predictable.

:: Very versatile as position can be transformed into a Bear Call Spread or Bull Put Spread easily.

Disadvantages Of Iron Condor Spread:

:: Larger commissions involved than simpler strategies with lesser trades.

:: Not a strategy that traders with low trading levels can execute.

Adjustments for Iron Condor Spreads Before Expiration :

1. If the underlying asset has gained in price and is expected to continue rising, you could close out all the call options and transform the position into a Bull Put Spread.

2. If the underlying asset has dropped in price and is expected to continue dropping, you could close out all the put options and transform the position into a Bear Call Spread. Such transformations can be automatically performed without monitoring using Contingent Orders.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by