How Does Bear Ratio Spread Work in Options Trading?

What Is A Bear Ratio Spread / Ratio Bear Spread?

A Bear Ratio Spread, or sometimes known as a Ratio Bear Spread, a

Put Ratio Spread or a Ratio Put Spread, is a similar strategy to the Bull Ratio Spread

except that Put options are used instead of call options.

It is essentialy an enhanced

Bear Put Spread

which achieves 3 aims; 1. To result in a higher profit when the underlying stock closes within the strike prices of the long and short options.

2. To reduce risk by eliminating upfront payment for the position. 3. To result in a profit even if the underlying stock stays stagnant upon expiration.

The Bear Ratio Spread is executed simply by selling more Out Of The Money (OTM) put options than long put options. The ratio of short and long put options depends on the trader's specific objective, hence the name "Ratio Spread". There are 3 types of Bear Ratio Spreads that can be established, covering all the possible ratio of short and long put options; 1. Bear Debit Ratio Spread. 2. Bear Free Ratio Spread and 3. Bear Credit Ratio Spread

What Is A Bear Debit Ratio Spread?

A Bear Debit Ratio Spread is established when the amount of put options that are sold do not cover the amount of money used on the long put options. One would usually put on a Bear Debit Ratio Spread only when one's broker do not allow credit spreads to be put on or when one wishes to reduce upfront payment for the Bear Put Spread while limiting losses if the underlying stock should rise instead of fall.

|

Example of Bear Debit Ratio Spread:

Assuming QQQQ at $44. Buy To Open 2 QQQQ Jan44Put @ $1.05, Sell To Open 3 QQQQ Jan43Put @ $0.60 In this example, you are selling 1 more Jan43Put than a Bear Put Spread. The net effect is, instead of paying $0.90 to put on this position (as in a Bear Put Spread), you are only paying only $0.30 due to the extra put option sold. |

The advantage of a Bear Debit Ratio Spread versus the Bear Free Ratio Spread or the Bear Credit Ratio Spread is that if the underlying stock should ditch strongly and close below the strike price of the short put options, a Bear Debit Ratio Spread stands to lose less money as there are lesser put options sold.

What Is A Bear Free Ratio Spread?

A Bear Free Ratio Spread is established when the amount of put options that are sold exactly covers the amount of money used on the long put options, thus resulting in no cash payment for the position. Again, one would usually put on a Bear Debit Ratio Spread only when one's broker do not allow credit spreads to be put on and wishes to not put an upfront payment for the position.

|

Example of Bear Free Ratio Spread:

Assuming QQQQ at $44. Buy To Open 4 QQQQ Jan44Put @ $1.05, Sell To Open 7 QQQQ Jan43Put @ $0.60 In this example, you are selling 3 more Jan43Put than a Bear Put Spread. |

The advantage of a Bear Free Ratio Spread is that you do not pay cash for it like the Bear Debit Ratio Spread and you stand to lose lesser money than a Bear Credit Ratio Spread if the underlying stock closes above the strike price of the short put options. However, because more put options are sold than a Bear Debit Ratio Spread, you will lose more money than the Bear Debit Ratio Spread if the stock should ditch strongly below the strike price of the short put options.

What Is A Bear Credit Ratio Spread?

A Bear Credit Ratio Spread or sometimes called a Put Credit Ratio Spread, is established when the total cost of the put options that are sold is more than the amount of money being paid on the long put options, thus resulting in a credit. This is the way most option traders want a Bear Ratio Spread to be set up as it returns the highest profit if the underlying stock closes exactly at the strike price of the short put options when compared to the above 2 methods.

|

Example of Bear Credit Ratio Spread:

Assuming QQQQ at $44. Buy To Open 4 QQQQ Jan44Put @ $1.05, Sell To Open 10 QQQQ Jan43Put @ $0.60 In this example, you are selling 6 more Jan43Put than a Bear Put Spread. The net effect is, instead of paying $0.90 to put on this position (as in a Bear Put Spread), you recieve ($0.60 x 10) - ($1.05 x 4) = $1.80 as credit for putting on the position. |

The advantage of a Bear Credit Ratio Spread lies in its maximum profit and the ability to make a profit if the underlying stock stays stagnant.

The number of put options you can sell is limited only to the maximum margin granted to your by your broker.

When To Use Bear Ratio Spread?

One should use a Bear Put Spread when one is confident in a rise in the underlying instrument up to a certain price. It is a good strategy to maximise profits on stocks that are expected to hit a technical support level.

Trading Level Required For Bear Ratio Spread

A Level 5 options trading account that allows the execution of naked options writing is needed for the Bear Ratio Spread as the additional options written are not covered by a corresponding long options position. Read more about Options Account Trading Levels.

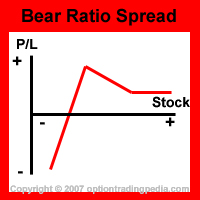

Profit Potential of Bear Ratio Spread :

The maximum profit potential of a Bear Ratio Spread is attained when the underlying stock closes at the strike price of the short put options. In this respect, the profit potential of a Bear Ratio Spread is limited. The profitability of a bear ratio spread can also be enhanced or better guaranteed by legging into the position properly.

Profit Calculation of Bear Ratio Spread:

Maximum Return = (Total Credit From Short put options + [(Difference in strikes - Price of Long Put) x number of Long Put contracts])

|

Profit Calculation of Bear Debit Ratio Spread:

Assuming QQQQ at $44. Buy To Open 2 QQQQ Jan44Put @ $1.05, Sell To Open 3 QQQQ Jan43Put @ $0.60 Max. Return = (0.6 x 3) + ([(44 - 43) - 1.05] x 2) = $1.70 |

|

Profit Calculation of Bear Free Ratio Spread:

Assuming QQQQ at $44. Buy To Open 4 QQQQ Jan44Put @ $1.05, Sell To Open 7 QQQQ Jan43Put @ $0.60 |

|

Profit Calculation of Bear Credit Ratio Spread:

Assuming QQQQ at $44. Buy To Open 4 QQQQ Jan44Put @ $1.05, Sell To Open 10 QQQQ Jan43Put @ $0.60 Max. Return = (0.6 x 10) + ([(44 - 43) - 1.05] x 4) = $5.80 |

Shadow my every masterful moves and picks to your financial success!

Precise Buy, Stop and Profit points given daily! Simply No Guesswork Involved!

Risk / Reward of Bear Ratio Spread:

Upside Maximum Profit: Limited

Maximum Loss: Unlimited

Position will start losing money if the stock falls past the strike price of the short put options. However, if the stock rises instead of

falls, then the maximum loss is limited to the net debit (if any).

In this sense, a Bear Free Ratio Spread and a Bear Credit Ratio Spread will

not lose any money if the underlying stock rises. In fact, if the underlying stock rises, a Bear Credit Ratio Spread will still make the

total credit as profit. In this sense, a Bear Ratio Spread is more of a neutral option strategy than a Bearish option strategy but because

it achieves it's maximum profit when the underlying stock drops to the strike price of the short put options, it is classified as a Bearish

option strategy.

In this sense, a Bear Free Ratio Spread and a Bear Credit Ratio Spread will

not lose any money if the underlying stock rises. In fact, if the underlying stock rises, a Bear Credit Ratio Spread will still make the

total credit as profit. In this sense, a Bear Ratio Spread is more of a neutral option strategy than a Bearish option strategy but because

it achieves it's maximum profit when the underlying stock drops to the strike price of the short put options, it is classified as a Bearish

option strategy.

|

Break Even Point of Bear Ratio Spread:

The breakeven point of a Bear Ratio Spread is the price below which the

position starts to go into a loss.

BEP: Strike Price of Short put options - [Maximum Profit / (number of short put options - number of long put options)]

|

Breakeven Point of Bear Debit Ratio Spread:

Assuming QQQQ at $44. Buy To Open 2 QQQQ Jan44Put @ $1.05, Sell To Open 3 QQQQ Jan43Put @ $0.60 BEP = 43 - [$1.70 / (3 - 2)] = $41.30 |

|

Breakeven Point of Bear Free Ratio Spread:

Assuming QQQQ at $44. Buy To Open 4 QQQQ Jan44Put @ $1.05, Sell To Open 7 QQQQ Jan43Put @ $0.60 BEP = 43 - [$4 / (7 - 4)] = $41.67 |

|

Breakeven Point of Bear Credit Ratio Spread:

Assuming QQQQ at $44. Buy To Open 4 QQQQ Jan44Put @ $1.05, Sell To Open 10 QQQQ Jan43Put @ $0.60 BEP = 43 - [$5.80 / (10 - 4)] = $42.03 |

As you noticed above, the Bear Credit Ratio Spread has the nearest breakeven point even though it has the highest profit potential.

As you noticed above, the Bear Credit Ratio Spread has the nearest breakeven point even though it has the highest profit potential.

|

Advantages Of Bear Ratio Spread :

Disadvantages Of Bear Ratio Spread :

Alternate Actions Before Expiration :

1. When the underlying stock reaches the strike price of the short put options before expiration, one may choose to buy back the extra short put options and transform the position into a Bear Put Spread in order to prevent a ditch in price past breakeven. This transformation can be automatically performed without monitoring using a Contingent Order.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by