How Does The Strap Straddle Strategy Work in Options Trading?

Strap Straddle - Introduction

The Strap Straddle, also known simply as a Strap, is a

long straddle which buys more call options than put options and has a bullish inclination.

As a

Volatile Options Strategy, Strap straddles are useful

when the direction of a breakout is uncertain but is inclined to upside. Strap straddles can also be used to balance straddles into

delta neutral positions. Strap straddles make a higher profit than a regular straddle when the underlying stock breaks upwards but will make a lesser profit

than a regular straddle when the underlying stock breaks downwards.

|

|

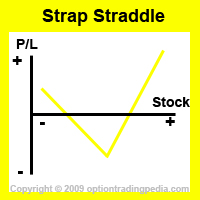

Main Differences Between Strap Straddle and Regular Long Straddle

The main difference between the Strap Straddle and the regular long straddle is that Straps buys more

call options than

put options. A regular long straddle buys the same number of

at the money put options and call options and has a symmetrical risk graph with equal profit to upside and downside. Strap straddles buy more at the money call options than put options, resulting in a

risk graph with steeper gains to upside than downside. Strap straddles would also have a farther downside breakeven point than upside as the lesser put options need to overcome the premium cost of more call options.

|

Strap Straddle Versus Regular Straddle Example

Assuming QQQQ trading at $42.57. Assuming Jan $43 Put has delta value of -0.75 and Jan $43 Call has delta value of 0.35. Regular Long Straddle Buy To Open 1 contract of Jan $43 Put at $2.38 Buy To Open 1 contract of Jan $43 Call at $1.63. Overall Delta = 0.35 - 0.75 = -0.4 Buy To Open 1 contract of Jan $43 Put at $2.38 Buy To Open 2 contracts of Jan $43 Call at $1.63. Net Debit = 2.38 + (1.63 x 2) = $5.64 |

The regular straddle can also be given a bearish inclination through buying more put options than call options, creating a Strip Straddle. Strip and Strap are the two variants of the straddle that options traders can use to introduce a bearish or bullish inclination to their straddles.

When To Use Strap Straddle?

One should use a Strap Straddle when one speculates that an uncertain stock might breakout to upside or to create a delta neutral straddle position .

How To Use Strap Straddle?

Buy to Open more At The Money (ATM) Call Options and Buy to Open At The Money (ATM) Put options.

How much more call options to buy for a Strap Straddle depends on your purpose of using the Strap Straddle. If you are putting on a Strap straddle in order to bias the position to an upwards breakout, you should buy enough call options such that the total delta value of the call options is twice that of the put options. If you are merely trying to create a totally delta neutral straddle position, you should buy enough call options to make the overall position delta of the Strap Straddle zero or closest to zero.

|

Strap Straddle Example

Assuming QQQQ trading at $42.57. Buy To Open 1 contract of Jan $43 Put at $2.38 Buy To Open 2 contracts of Jan $43 Call at $1.63. Net Debit = 2.38 + (1.63 x 2) = $5.64 |

Trading Level Required For Strap Straddle

A Level 2 options trading account that allows the buying of call and put options is needed for the Strap Straddle. Read more about Options Account Trading Levels.

Profit Potential of Strap Straddle :

Strap Straddles have unlimited profit potential as long as the stock continues moving in one direction.

Profit Calculation of Strap Straddle:

Profit = [(Stock price - strike price of Strap straddle) x number of call options (if stock is higher) or number of put options (if stock is lower)] - net debit

Maximum Loss = Net debit when stock closes at the options strike price.

|

From the above example :

Assuming QQQQ Rallies To $56 Profit = [(56 - 43) x 2] - 5.64 = 26 - 5.64 = $20.36 or 361% Maximum Loss = $5.64 |

Risk / Reward of Strap Straddle:

Upside Maximum Profit: Unlimited

Maximum Loss: Limited

Breakeven Points of Strap Straddle:

A Strap Straddle makes a profit if it goes above its upper breakeven point or below its lower breakeven point.

Lower Breakeven Point = Strike price - net debit

Upper Breakeven Point = Strike price + (net debit/[number of call options/number of put options])

|

From the above example :

Lower Breakeven Point: 43 - 5.64 = $37.36 Upper Breakeven Point: 43 + (5.64/[2/1]) = 43 + 2.82 = $45.82 You would notice at this point that a Strap straddle has a nearer upper breakeven point than its lower breakeven point. This is the effect of buying more call options than put options. |

Advantages Of Strap Straddle:

:: Higher profit than a regular straddle if stock breaks out to upside.

:: Closer upper breakeven point.

Disadvantages Of Strap Straddle:

:: Higher minimal cash outlay needed.

:: Higher maximum loss than a regular straddle.

Alternate Actions for Strap Straddles Before Expiration :

1. If the underlying asset has rallies and is expected to continue rising, you could sell to close the put Options and hold the long call Options.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by