How Does The Synthetic Positions Work in Options Trading?

Synthetic Positions - Definition

A combination of stocks and/or options that return the same payoff characteristics of another stock or option position.

Synthetic Positions - Introduction

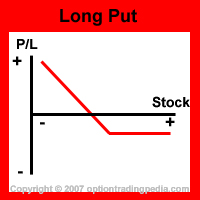

In the early days of option trading where only call options are publicly traded, option traders who wished to speculate a downwards move while limiting upside risk need to "create" or emulate the payoff characteristics of a put option through the buying of call options and simultaneously shorting the underlying stock. The combination of call options and short stocks creates a synthetic put option, or a position with the exact characteristics of a put option. When the underlying stock drops, the call options eventually expires out of the money, losing all of its extrinsic value while the value of the short stock rises. This is exactly the same as holding put options where its extrinsic value decays away upon expiration leaving the net profit on the drop of the underlying stock.

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares dropped to $40 upon expiration of the call and put options.

|

In the above illustration, the Long Call Option + Short Stocks creates a Synthetic Put Option where the profits and losses are exactly the

same as if Peter bought put options.

In fact, synthetic positions are very widely used and packaged as individual option strategies themselves. The Fiduciary Calls option trading strategy

is in fact, a Synthetic Protective Put option trading strategy! Furthermore, there are many option traders who constantly creates synthetic positions

through their buying of options and stocks without realizing it themselves. Having a comprehensive understanding of Synthetic Positions also allows you

to prevent creating unfavorable Synthetic Positions unknowingly. Completely understanding synthetic positions is a must for every

position traders.

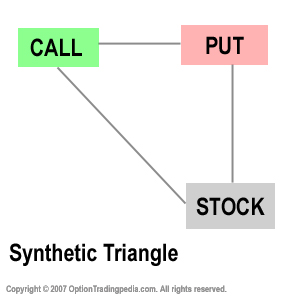

Synthetic Positions - The Synthetic Triangle

A Synthetic Triangle is a simple memory aid used to visualize the synthetic relationship between options and stocks.

What the Synthetic Triangle is saying is, a combination of two elements in the synthetic triangle creates a synthetic position of the third element. This synthetic triangular relationship is governed by the principle of Put Call Parity.

Synthetic Positions - Basics

There are 6 basic synthetic positions relating to combinations of put options, call options and their underlying stock in accordance to the

synthetic triangle:

1. Synthetic Long Stock = Long Call + Short Put

3. Synthetic Long Call = Long Stock + Long Put

5. Synthetic Short Put = Short Call + Long Stock

In order for the synthetic triangle relationship to work, all options used together must be of the same expiration, strike and represent the same amount of shares used in combination.

It is important to take note here that all options mentioned here are At The Money (ATM) Options. It is important to take note here that all options mentioned here are At The Money (ATM) Options.

|

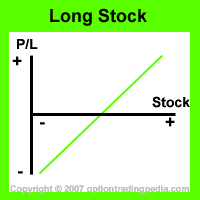

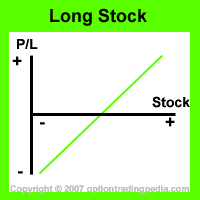

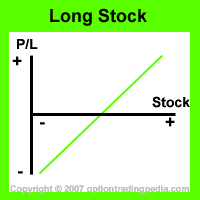

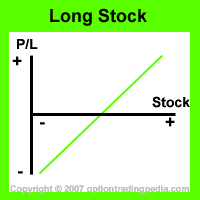

Synthetic Positions - Synthetic Long Stock

Can you create stock out of options? Yes! You can create a synthetic long stock position simply by:

Synthetic Long Stock = Long Call + Short Put

|

= |

|

+ |

|

When you buy a stock, you are exposed to unlimited profits and unlimited losses while losing nothing when the stock remains stagnant. A synthetic long stock completely duplicates those characteristics. The premium gained from the short put covers the premium on the long call (thus losing nothing if the stock remains stagnant), the call option grants unlimited profits and the short put options introduced the unlimited loss.

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares rises to $60 upon expiration of the call and put options.

|

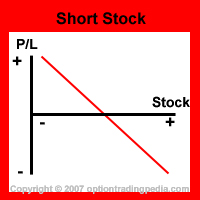

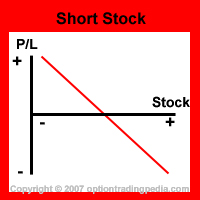

Synthetic Positions - Synthetic Short Stock

Can you short a stock without really shorting the stock itself? Yes, you can create a synthetic short stock position by:

Synthetic Short Stock = Short Call + Long Put

|

= |

|

+ |

|

When you short a stock, you are exposed to unlimited loss and unlimited profit while losing nothing when the stock remains stagnant. A synthetic short stock completely duplicates those characteristics. The premium gained from the short call covers the premium on the long put (thus losing nothing if the stock remains stagnant), the long put option grants unlimited profits and the short call options introduced the unlimited loss.

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares drops to $40 upon expiration of the call and put options.

|

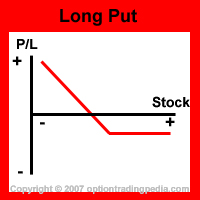

Synthetic Positions - Synthetic Long Call

If you are holding a put option or a stock, how can you transform it into a call option without selling your present positions? Simply by

constructing a Synthetic Long Call by:

Synthetic Long Call = Long Stock + Long Put

|

= |

|

+ |

|

If you are an experienced option trader, you would be able to immediately tell that the above equation is saying that Fiduciary Calls = Protective Puts! That's right! That's what this synthetic position is trying to say.

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares rallies to $60 upon expiration of the call and put options.

|

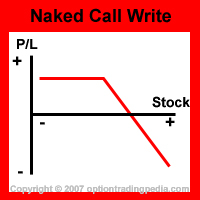

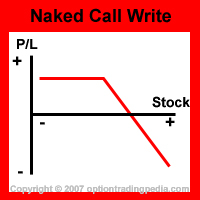

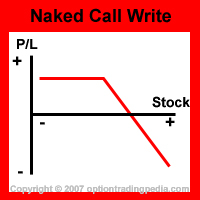

Synthetic Positions - Synthetic Short Call

If you are holding a short put option or a short stock position, how can you transform it into a short call option position without selling your present positions? Simply by

constructing a Synthetic Short Call by:

Synthetic Short Call = Short Stock + Short Put

|

= |

|

+ |

|

When you short a call option, you are exposed to limited profits, unlimited losses and the premium on the call options decay to your advantage. The short stock contributes the limited downside profits (all the way to $0 so technically unlimited profits to downside) and the short put options limit that profit to the premium decay of the put options while offsetting part of the loss to upside.

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares drops to $40 upon expiration of the call and put options.

|

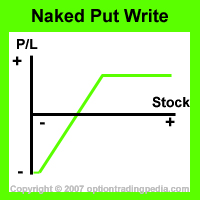

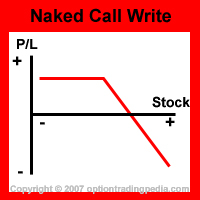

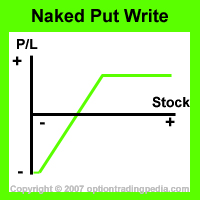

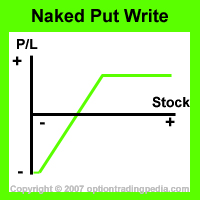

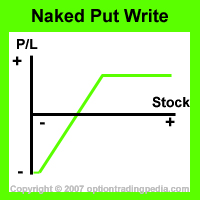

Synthetic Positions - Synthetic Short Put

If you are holding short call position and want to participate on an upwards move on that stock without closing your short call position, you can

construct a Synthetic Short Put by:

Synthetic Short Put = Short Call + Long Stock

|

= |

|

+ |

|

In a Short Put option position, you are exposed to limited profit to upside and unlimited loss potential while gaining the extrinsic value no matter what happens. Long Stocks contributes the unlimited loss potential to the synthetic position while the short call limits the potential upside profit.

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares rallies to $60 upon expiration of the call and put options.

|

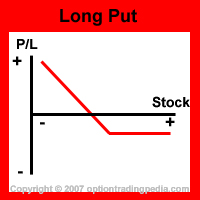

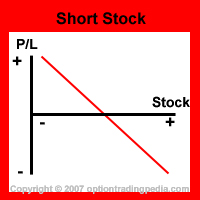

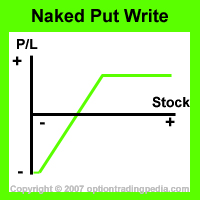

Synthetic Positions - Synthetic Long Put

If you are holding long call position and want to participate on an downwards move on that stock without closing your long call position, you can

construct a Synthetic Long Put by:

Synthetic Long Put = Long Call + Short Stock

|

= |

|

+ |

|

|

Assuming XYZ shares trading at $50 with $50 strike price Call Option and Put Option trading at $3.00 each.

Assuming XYZ shares drops to $40 upon expiration of the call and put options.

|

Synthetic Positions - Why Use Synthetic Positions?

Why would anyone create a synthetic long call when they can simply buy call options? In fact, why would anyone use synthetic positions at all

when all the instruments are now available to all option traders? Synthetic positions are useful for option traders who wish to speculate on a

reverse expectation on their current holdings without closing the current holdings. Synthetic positions are also much more flexible than

its equivalent instrument, making it possible to take advantage of changing conditions quicker and at a lower transaction cost.

Synthetic Positions For Reversal Of Expectations

For example, you are short call options,

speculating a moderate drop in the underlying stock. However, recent developments convinced you that the underlying stock could make a moderate upwards

move instead of a moderate downwards move. Instead of closing your short call option position, you could simply

transform it into a synthetic short put position which profits when the underlying stock makes a moderate rally through buying a proportionate

amount of the underlying stock.

-->

-->

Synthetic Positions For More Flexibility

Synthetic positions allows an option trader to quickly change from one expectation to another without making a complete change to

existing holdings. This makes the change faster and cheaper. From the above example, if the underlying stock continues to go up and is expected to

make a sustained rally,

you would simply transform the synthetic short put position into a long stock position by closing out the short call options.

-->

-->

If you had simply closed out your short call options and then wrote put options initially, you would now have to close out your

short put options and buy either the underlying stock or a call option right now. Synthetic positions allowed that transition from

a moderate down outlook to a moderate up outlook to a sustained up outlook very smoothly.

Synthetic Positions For Lower Transaction Cost

In the above example, if you had done the conventional method of buying and selling positions, you would have incurred 4 transactions in all:

Write Call ---> Buy Back Call ---> Write Put ---> Buy Back Put ---> Buy Stocks

If you had used synthetic positions instead, you would have incurred only 3 transactions:

Write Call ---> Buy Stocks ---> Buy Back Call

Lesser transactions translates into lower transaction cost, which makes synthetic positions the most cost efficient way of trading in volatile times.

A comprehensive knowledge of synthetic positions allows an option trader to better hedge existing holdings and become more flexible in

taking advantage of short term price anomalies. This is why all Market Makers

need to be completely familar with synthetic positions.

Synthetic Positions - Conversions & Reversals

Conversion & Reversals are important synthetic position concepts pertaining to the closing out of synthetic positions using the actual financial instrument that they represent in order to both maintain the original position and hedge against short term price movements. Conversion & Reversals can also be used to take advantage of options arbitrage opportunities. Read more about Conversion & Reversal Arbitrage.

Synthetic Positions - Pricing

The principle of Put Call Parity governs the pricing of synthetic positions, reducing arbitrage opportunities through conversion or reversal.

Synthetic Positions Questions:

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by