How Does Call Time Spreads Work in Options Trading?

Call Time Spread - Introduction

The Call Time Spread, being one of the three popular forms of Time Spreads (the other 2 being the Put Time Spread and the Ratio Time Spread), is a neutral options trading strategy that profits when a stock remains stagnant.

A Call Time Spread profits primarily from the difference in rate of time decay between the near term short options and the long term LEAPs.

This is possible as near term option premiums decay faster than long term option premiums. This is certainly a unique way of profiting that is possible only in options trading.

|

|

Because the Call Time Spread buys LEAPS which are more expensive than the short term options sold, executing this options trading strategy results in a net debit and is therefore a form of Debit Spread. This means that you pay cash in order to put on the position.

Types of Call Time Spreads

There are two types of Call Time Spreads; Call Diagonal Time Spread (also known as Diagonal Call Time Spread) and Call Horizontal Time Spread (also known as Horizontal Call Time Spread). Call Diagonal Time Spreads buy and write options of different expiration months and different strike prices. In this case, it is classified as a Diagonal Spread. Call Horizontal Time Spreads buy and write options of different expiration months but at the same strike price. In this case, it is classified as a Horizontal Spread. We will be exploring both versions of the Call Time Spreads here.

When To Use Call Time Spread?

Call Time Spreads could be used when you wish to profit from a stock that is expected to stay stagnant or trade within a tight price range for the short term while keeping a long term call option position in place in case of future breakouts.

How To Use Call Time Spread?

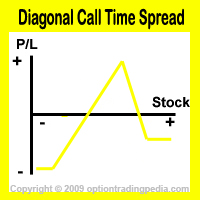

Call Diagonal Time Spread

In this version of the Call Time Spread, In the Money (ITM) LEAPS are bought and then At the Money (ATM) or Out of the Money (OTM) near term calls are sold against the LEAPS.

|

Example : Assuming QQQQ trading at $45 now. Buy To Open 10 contracts of QQQQ Jan 2008 $44 Call options at $5.70. Sell To Open 10 contracts of QQQQ Jan 2007 $45 Call at $0.75. |

Please read the full tutorial on Diagonal Call Time Spread.

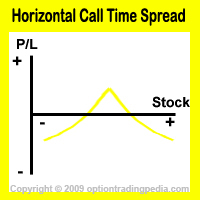

Call Horizontal Time Spread

In this version of the Call Time Spread, At The Money (ATM) LEAPS call options are bought and then ATM near term calls are sold against the LEAPS call options.

|

Example : Assuming QQQQ trading at $45 now. Buy To Open 10 contracts of QQQQ Jan 2008 $45 Call options at $4.70. Sell To Open 10 contracts of QQQQ Jan 2007 $45 Call at $0.75. |

Please read the full tutorial on Horizontal Call Time Spread.

Profit Potential of Call Time Spread :

Both the Horizontal Call Time Spread and the Diagonal Call Time Spread makes their maximum profit potential when the stock closes at the strike price of the short term call options upon expiration of the short term call options.

Profit Calculation of Call Time Spread:

The value of a Call Time Spread during expiration of the short call options can only be arrived at using an options pricing model such as the Black-Scholes Model because the expiration value of the long term call options can only be arrived at using such a model.

Risk / Reward of Call Time Spread:

Upside Maximum Profit: Limited

(limited to net debit paid)

Call Time Spread Breakeven Calculation:

The breakeven point of a Call Time Spread is the point below which the position will start to lose money if the underlying stock rises or falls strongly and can only be calculated using the Black-Scholes model.

Advantages Of Call Time Spread:

Disadvantages Of Call Time Spread:

Alternate Actions for Call Time Spreads Before Expiration :

1. If you wish to profit from a rally in the underlying asset, you could buy back the short call options before it expires and allow the LEAP Call Options to continue its profit run.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by