How Does Naked Put Write Work in Options Trading?

Naked Put Write - Introduction

Naked Put Write is sometimes known as a Put Write, Naked Put, Write Put Options, Short Put,

Uncovered Put Write, Selling Naked Puts or Short Put Options.

A Naked Put Write is when you Sell To Open Put options without first being short in the underlying stock.

One would use a Naked Put Write to speculate a quick rise in the price of the underlying stock and still to make a profit even if the underlying stock stays stagnant.

|

|

One should be familar with

put options and

options trading before executing the Naked Put Write strategy.

Complex bullish option strategies, such as the Naked Put Write, usually have added benefits such as profiting even if the underlying stock stays stagnant or profiting even if the underlying

stock should fall slightly instead of rise. This is because short options positions puts

time decay in your favor, the more the value of the

options you sold decay, the more you profit from the sale. The Naked Put Write, as the simplest of the complex bullish option strategies, is no exception. By writing

a put option, you are not only making money if the underlying stock rises due to delta effect,

you are also putting Time Decay, which is the biggest evil of buying

stock options, in your favor as

Time Decay works against the favor of the buyer of the put options that you sold. Yes, this means that if the options you sold failed to rise in

price, you also profit from its premium value!

Writing a put option is never really "Naked" or "Uncovered" because you need to put forward an amount of cash known as a Margin in order to cover potential losses. In fact, because you are obligated to buy the underlying stock at the strike price of the put options

sold, some option trading brokers require

option traders to have that corresponding amount of money before they are allowed to sell a put option. This is known as Cash Secured Put.

(Find out how Writing Out Of The Money Put Options can fulfill the best of all worlds)

When To Use Naked Put Write?

One would use a Naked Put Write when speculating a small or moderate rise in the underlying stock. This rise need not be a dramatic one like in the Long Call Options strategy as it only need to rise enough to allow the put options to expire out of the money (OTM).

p>|

Example : Assuming QQQQ at $44. Sell To Open 10 QQQQ Jan44Put for $0.80. You will make the entire $0.80 in profit even if the QQQQ expires at $44.05. |

If you are expecting a huge, dramatic rise in the underlying stock, you would use a Long Call Options strategy instead because, using the Naked Put Write as in the example above, you would make only $0.80 no matter how high the underlying stock goes up to.

How To Use Naked Put Write?

A Naked Put Write is a simple option strategy where you simply sell to open put options at a strike price which you are confident that the underlying stock would rise beyond by option expiration. One would usually sell put options of the nearest expiration month so that the underlying stock would not have time to go back in the money (ITM).

|

Example : Assuming QQQQ at $44. If you expect QQQQ to rise to $46, you could Sell To Open QQQQ Jan45Put. If you expect QQQQ to rise very slightly, you could Sell To Open QQQQ Jan44Put. |

The more In The Money (ITM) Put Options that you sold, the higher your maximum profit potential but the more

QQQQ needs to move in order to expire that option out of the money (OTM).

Here is a table showcasing the differences:

| Assume QQQQ Trading At $44 Now. | |||||||

| Strike Price | Price |

Amount QQQQ Needs To Move For Max Profit |

Profit If QQQQ Expires @ $44.01 |

||||

| $43 | $0.10 | 0 | $0.10 | ||||

| $44 | $0.80 | $0.01 | $0.80 | ||||

| $45 | $1.80 | $1.01 | $0.81 | ||||

Naked Put Write on out of the money put options is a very interesting option strategy that it warrants a page on its own. Please read about Writing Out Of The Money Put Options.

Trading Level Required For Naked Put Write

A Level 5 options trading account that allows the execution of naked writes is needed for the naked put write. Read more about Options Account Trading Levels.

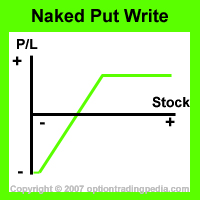

Profit Potential of Naked Put Write :

The Naked Put Write has a limited profit as its maximum profit is the price at which the put option is sold no matter how high the underlying stock goes up. The Naked Put Write also profits from the premium value decay even if the underlying stock stays stagnant. This enables the Naked Put write to have a much higher chance of turning a profit than a simple Long Call Option strategy.

Profit Calculation of Naked Put Write :

There are 2 ways to calculate profit for Naked Put Write : Before Expiration and After Expiration.

Before expiration, the Naked Put Write profits from a fraction of the move in the underlying stock based on its delta value and a fraction of the put option's premium value due to time decay based on it's theta value.

|

Following up from the above example:

Sell to open 1 lot of QQQQ Jan44Put for $0.80 per contract with a delta value of 0.5 and theta value of -0.018. QQQQ rises to $44.80, 5 days later. Profit = [($44.80 - $44) x 0.5] + [(0.018 x 1) x 5] / 0.8 = 61.25% profit. |

Please note that the above figures are only arbituary and that precise calculation of expected profit before expiration can only be arrived at

using a stock option pricing model such as the Black Scholes Model.

Please note that the above figures are only arbituary and that precise calculation of expected profit before expiration can only be arrived at

using a stock option pricing model such as the Black Scholes Model.

|

After Expiration

Upon expiration, there can be 2 possible scenarios for the Naked Put Write :

1. The underlying stock rises higher than the strike price

When the underlying stock is trading higher than the strike price of the put options that you sold upon expiration, those put options

expires out of the money (OTM) and the entire price of the put options that you sold becomes your profit.

2. The underlying stock is trading lower than the strike price

Profit / Loss = Net Credit - (Strike Price - Stock Price)

|

Following up from the above example:

Sell to open 1 QQQQ Jan44call for $0.80 per contract. If QQQQ falls to $43.5 at expiration. Profit = $0.80 - ($44 - $43.5) = $0.30 or 37.5% If QQQQ falls to $42 at expiration. Loss = $0.80 - ($44 - $42) = $1.20 |

Maximum Loss Of Naked Put Write

Contrary to common believe about naked positions and what other option trading sites have wrongly assumed, Naked Put Write is

unlike a Naked Call Write

where maximum loss is unlimited. Maximum loss of a naked call write is unlimited because the underlying stock can,

theoretically, move higher infinitely. However, in a Naked Put Write, where the position loses money when the underlying stock

goes down, the stock can only go down all the way to zero, not infinity! Which means that there IS a limit to the maximum possible loss of a

Naked Put Write!

Maximum loss = (Strike Price - Premium Value) x Number of Contracts.

|

Following up from the above example:

Sell to open 1 lot of QQQQ Jan44Put for $0.80 per contract. QQQQ falls to $0, Maximum Loss = ($44 - $0.80) x 100 = $4320 |

Risk / Reward of Naked Put Write:

Upside Maximum Profit: Limited

Limited to net credit recieved.

Maximum Loss: Limited

Limited to 100% of the strike price when stock falls to zero

Because you can lose an increasing amount of money as long as the underlying stock continues to fall, you should always place a reasonable

stop loss when executing a Naked Put Write.

Because you can lose an increasing amount of money as long as the underlying stock continues to fall, you should always place a reasonable

stop loss when executing a Naked Put Write.

|

Break Even Point of Naked Put Write:

The breakeven point for a Naked Put Write is the point beyond which the underlying stock can drop before the position starts to go into a loss.

This is calculated as:

Breakeven = Strike Price - premium value of put options sold.

|

Following up from the above example:

QQQQ is trading at $44 and QQQQ's Jan44Put is At The Money and has no intrinsic value. The whole price of $0.80 is extrinsic value. Thus the breakeven point would be $44 - $0.80 = $43.20. QQQQ needs to fall below $43.20 before the position starts making a loss. |

One would notice by now that a Naked Put Write has a much higher chance of a profit than simply long Call Options as you will make money even if the stock does not move and lose money only when the stock drops below the breakeven point.

Advantages Of Naked Put Write:

:: As the strategy results in a net credit, risk is reduced.

:: It is a simple option strategy which requires no precise calculation to execute, unlike other more complex option strategies.

:: As it involves trading only one kind of option, the commissions involved would be much lower than the rest of the other

more complex option strategies

:: It allows you to profit even if the underlying stock stays completely stagnant.

:: It is a versatile option strategy which can be transformed into other option strategies in order to accomodate changing market outlooks prior to expiration.

:: Unlike in a Long Call Option, a Naked Put Write offers you a degree of protection from loss if the underlying stock falls slightly instead of rises.

Disadvantages Of Naked Put Write:

:: Potential profit is limited, so if the stock goes into a huge rally, one could miss out on the profit opportunity.

:: One could lose a lot of money if the underlying stock falls drastically.

:: As Naked Put Write is a credit strategy that involves

margin, beginners are rarely allowed to execute it with most online brokers.

:: As margin requirements can be quite large, one may not be able to put on as many positions as one may simply by buying call options.

Alternate Actions for Naked Put Write Before Expiration :

1. If the underlying stock has moved so much as to leave the put options with very little value left before expiration, one may

wish to buy to close the put options in order to profit these profits instead of risking it all by holding till expiration.

2. If the underlying stock is about to pull back from it's quick rally, you could transform the Naked Put Write into a

Bear Put Spread in order to profit from the downturn

by buying an equivalent number of At The Money (ATM) put options.

3. If the underlying stock proves to be trading within a narrow trading range, one could transform Naked Put Write into a

Short Strangle by further Selling To Open a corresponding number of Out Of The Money (OTM) Call Options.

Adjustments for Naked Put Write During Expiration :

1. One should always allow Out Of The Money (OTM) put options to expire and always Buy To Close these put options if they are In The Money (ITM).

Questions on Naked Put Write

:: "Can I Close Naked Put Before Expiration?"

:: "Placing Limit Order for Naked Put Write?"

:: "Difference Between Selling Put and Covered Put?"

:: "How Can I Repair A Losing Short Put?"

Videos On Naked Put Write

Video: AAPL Naked Put Write |

Buy To Close AAPL Put Write |

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by