What is Volatility Crunch? What cause Volatility Crunch? How to trade with Volatility Crunch?

Volatility Crunch - Introduction

Volatility Crunch is the phenomena whereby extrinsic value of options make sharp declines following the occurance of significant corporate events such as earnings.

Volatility crunch is a market driven phenomena which has caught many options trading beginners off guard, especially those who tried to speculate on earnings release through buying call and/or put options. Buyers of stock options prior to earnings release is the most common way options trading beginners are introduced to Volatility Crunch where they were shocked to find that not only have they not made any money on their options even though the stock went in their favor but could also sometimes lose all their money in one trade.

What is Volatility Crunch?

A crunch is defined as breaking down of an object into smaller pieces or particles. Indeed, a volatility crunch happens when "Volatility" has been "broken down into smaller pieces". Volatility is crunched when a high level of volatility drops tremendously, quickly. So, what impact does volatility crunch has? When expected volatility (implied volatility) of a stock drops, the extrinsic value of its options drops as well! Depending on how high the volatility build up, and hence the extrinsic value of the options, when you bought the options, Volatility Crunch could depress extrinsic values to the point where you may not profit even when the stock does move in your favor. In fact, sometimes you may end up with a loss! Let's look at an example of volatility crunch without the technical details.

XYZ Company is expected to release its earnings in 5 days time. Speculation is for a positive surprise and speculators have started pouring into XYZ's stocks and options. XYZ company stocks are trading at $100 and its $110 strike price call options rose from $1.00 to $3.00 over the 5 days as demand and volatility builds up. You decided to buy the $110 strike price call options in order to speculate on a positive surprise the day before earnings when volatility is highest. You figured that even if XYZ company stocks do not move beyond $110 on the earnings release, its delta of 0.30 would still be able to at least capture some profits and that because you intend to hold the position only for 1 days, time decay should not hurt your position. Looks like a low risk, low investment speculation.

XYZ Company subsequently released favorable earnings and its stock rose form $100 to $105 in one day. A 5% gain! That ought to produce a 50% gain on your 0.30 delta call options! You eagerly accessed your account to lock in the potential profit only to discover that instead of making a 50% profit, those $110 call options have made a 50% loss, now trading at just $1.50! What happened? It can't be time decay since its just one day and it can't be delta!

This is the exact scenario that most options trading beginner experienced on their first encounter with Volatility Crunch. Yes, what happened was Volatility Crunch. The extrinsic value of options depends greatly on implied volatility. When a stock is expected to make big moves, implied volatility rises due to demand and pricing factors. When that happens, extrinsic value rises as you can see from the example above, from $1.00 to $3.00 over just 5 days. Yes, those $110 call options are just extrinsic value and no intrinsic value since they are out of the money. However, when the volatile condition, which is the earnings in the example above, is over, implied volatility drops down to normal levels, taking the excess extrinsic value built up before the event with it! So, the little bit of profit captured by the option's delta hardly offsets the loss of extrinsic value due to volatility crunch, often times resulting in a loss. This is especially common when playing an Earnings Straddle.

What Causes Volatility Crunch

As we can see from the above example, volatility crunch is caused by a sudden and quick drop in implied volatility following the completion of an expected volatile event. Any events that create uncertainty in the market in general or to specific stocks, increases implied volatility. Such events include, but are not limited to, earnings, corporate announcements, verdicts, special filings etc etc. This implied volatility often builds up leading up to the event as speculators starts pouring into the stock, increasing demand. As such, the day before (or even just before) the completion of a volatile event usually sees the highest implied volatility and hence extrinsic value, making it extremely difficult for any options buyers to make any profit.

Volatility Crunch Case Study

Subject: AEO American Eagle Outfitters Earnings Release 27 August 2009 BMO.

As of 24 Aug Close : AEO $14.26. Sep$15Call 0.4/0.5. Implied volatility 49.78. Delta 0.375. Theta -0.0142.

As of 26 Aug Close : AEO $14.58. Sep$15Call 0.6/0.65. Implied Volatility 55.08. Delta 0.45. Theta -0.0175.

As of 27 Aug Close : AEO $14.00. Sep$15Call 0.2/0.25. Implied Volatility 41.81. Delta 0.27. Theta -0.0109.

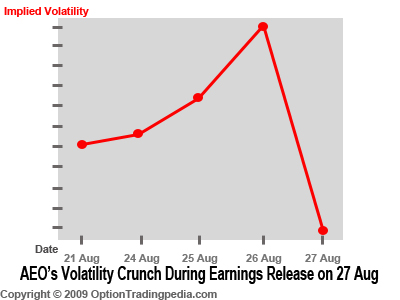

As we can see above, Implied Volatility rose from 49.12 to peak at 55.08 running up to the day before AEO's earnings release and by close of earnings release day, Volatility Crunch sets in, depressing implied volatility from 55.08 to 41.81. Holding AEO's price steady at $14.58 (price the day before earnings release) but depressing implied volatility to 41.81 and running it through the Black-scholes model, a theoretical price of $0.43 was obtained. This means that with AEO at $14.58 and implied volatility depressed from 55.08 to 41.81, the Sep$15Call would also have dropped by $0.22 from $0.65 to $0.43! A loss of almost 34% overnight! That's volatility crunch.

Lets run these same figures through the black-scholes model again but this time keeping the price of AEO steady at $14.67, which is the price on 21 Aug itself, as well as days to expiration steady so as to eliminate effects of time decay and see the effects of volatility crunch with all else equal.

Subject: AEO, keeping stock price stagnant at $14.67 throughout the whole event.

As of 21 Aug Close : Sep$15Call 0.63. Implied Volatility 49.12.

As of 24 Aug Close : Sep$15Call 0.64. Implied volatility 49.78.

As of 25 Aug Close : Sep$15Call 0.67. Implied Volatility 51.53.

As of 26 Aug Close : Sep$15Call 0.73. Implied Volatility 55.08.

As of 27 Aug Close : Sep$15Call 0.52. Implied Volatility 41.81.

From the table above, we can clearly see the price of AEO's Sep$15Call rising for the 4 days leading up to the earnings release day as implied volatility rose before dropped from $0.73 to $0.52 after the earnings release even though the stock price did not change. That's a clearer view of Volatility Crunch at work.

The picture below maps the implied volatility of AEO's Sep$15Call leading up to its earnings release day, clearly outlines volatility crunch.

Profiting from Volatility Crunch

As we can see so far, volatility crunch in options trading makes it extremely difficult for speculators to profit from a volatile event by buying options. This is also why almost all the "options trading gurus" out there only recommend writing options in order to profit from such periods. Is writing options the only way to profit from volatility crunch? Certainly if it is difficult to profit through buying options, writing options should be alot wiser right? Well, not entirely. There are also ways to buy options for a profit during expected volatility crunch and we will explore some of these methods here.

Delta Neutral Vega Positive Strategies

Your position gains positive Vega whenever options are bought. Positive vega in options trading means that the value of the position rises when implied volatility rises and falls when implied volatility falls. Positive vega positions are excellent for holding for the days leading up to volatile events as you can see in the picture of AEO's implied volatility chart above. As implied volatility rises, so does the value of the position. Sounds like a direct way to profit from volatility but what about movements in the stock during that period? As you can see from the AEO case study above, the value of its Sep$15Call dropped from $0.65 to $0.5 from 21 Aug to 25 Aug even though implied volatility rose due to a drop in the stock value. This is why putting the position on as a delta neutral position is important. A delta neutral position is a position with overall delta value of zero or close to zero. Such a position have offsetting components that move opposite to each other when the underlying stock moves, hence resulting in a net zero value change for the position itself. An example of such a strategy is the Long Straddle if the delta value of at the money call and put options are exactly 0.5 and -0.5 or Strip Straddle / Strap Straddle if the delta value is inclined to one side.

Vega Negative Strategies

Since volatility crunch reduces implied volatility overnight, selling options with high extrinsic value the day before an expected volatile event sounds like a sure fire way of making money, right?

Indeed, writing out of the money call or put options or both is a high probability way of making a profit if the stock does not move so much as to result in those options going in the money, resulting in a loss which is too high to cover using the extrinsic value gained.

Volatility Crunch Questions

:: Why Did My Call Options Decline on Positive Earnings?

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by